Back above 1.1214-18 area

Looking at the EURUSD, the pair is trading a new session highs, after opening lower and near the low levels for the day (at 1.1203).

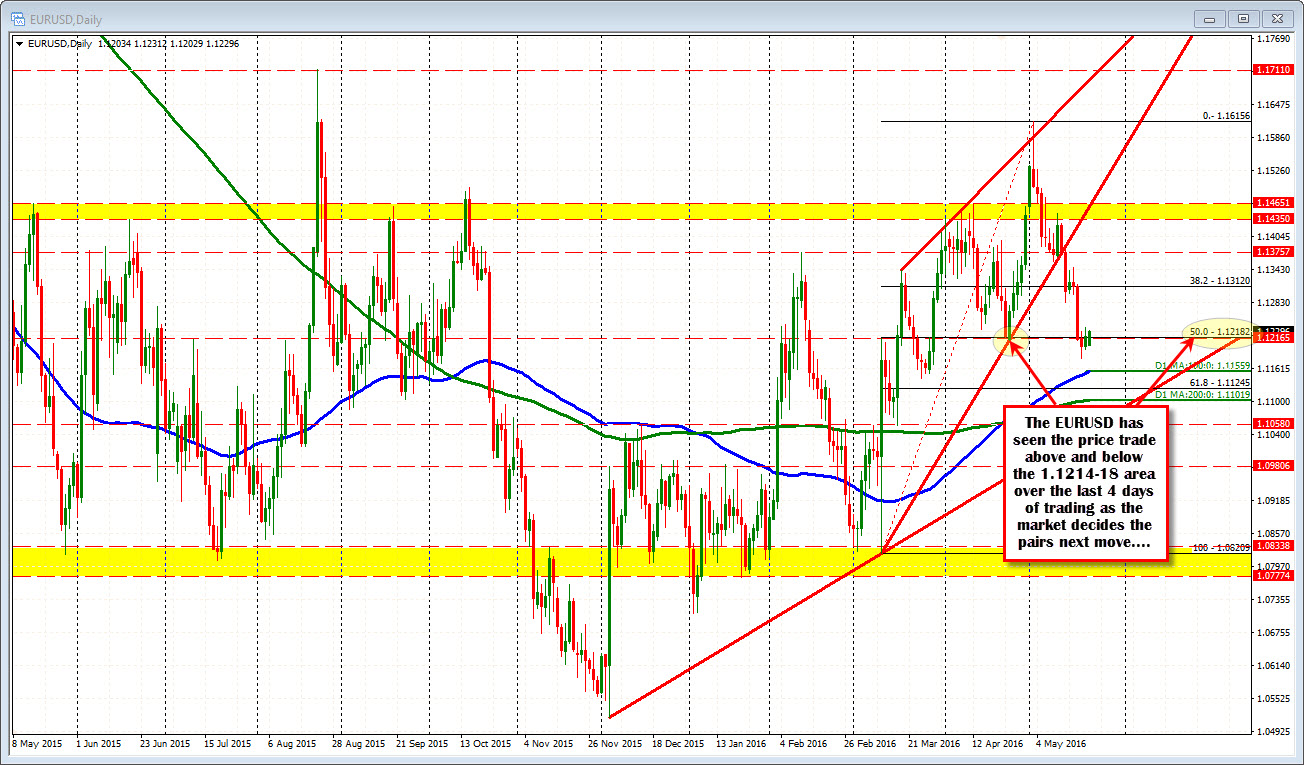

The move higher has now taken the price above the 1.1214-18 area which, for me is a dividing line for bullish/bearish this week The 1.1214 was the low from April's trading. The 1.1218 is the 50% of the move up from March low.

The market moved down to the line on Wednesday last week, and has been waffling around the level since that time. The market is trying to determine what it wants to do next. Just looking at the chart you can see higher. Since November there are been higher lows and higher highs.

From another perspective you could see a big failure above, a break of a trend line and the 38.2%.

Hence the reliance on line like the 50% and the April low.

With the price now above, the bias turns back to the upside, but be aware that there is still hurdles to get to and through.

Looking at the hourly chart, the high price from Friday at 1.1236, extended briefly above the 1.12295 level was Thursday's high. The 1.12437 level is the 38.2% of the move down from last weeks high. That is the next minimum hurdle. Above that is the 100 hour MA at 1.12535. The low from March 17 comes in at 1.1254 not far from the 100 hour MA. If the price is to go higher, these are the steps that need to be taken.

The good news for the dip buyers is that these levels are not far away. The not so great news is that it may be a bit more bullish to get above the 1.1214-18 level, but there are other hurdles to overcome and they are lining up...