The main event has a GBP attached to it

The EURUSD is a side show today and is relegated to being outside the main tent where all the action is happening with anything that has a GBP attached to it (the GBPUSD has broken above 1.4601).

While the GBPUSD surges the EURUSD is lower on the day (hence the tumble in the EURGBP). The expectation might be that the EURUSD might be dragged higher by the GBPUSD, but there are those higher dollar pangs as Fed officials ruffle their hawkish feathers. Later today the FOMC meeting minutes will be dissected to see if they tell that story or are they just acting macho.

Technically for the pair, looking at the hourly chart, the price has moved to new week lows (taking out yesterday's low at 1.1297), and also has taken out the low from Friday at 1.1282. Admittedly, the price has traded above and below the 1.1282 level over the last 5 hours of trading. However, since breaking the 1.1297 level (i.e. the low for the week), that level has not been breached (the highest high came in at 1.12957). Going forward that level will be eyed as close resistance for shorts.

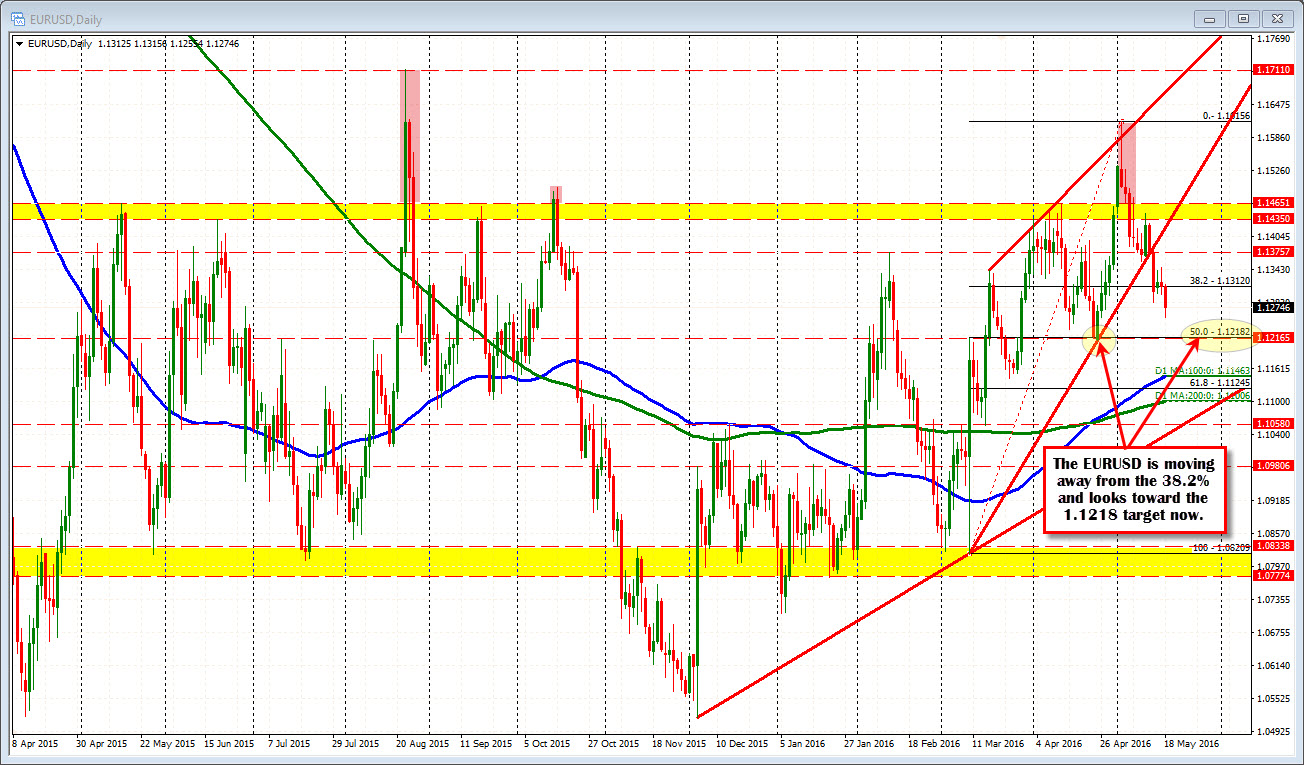

Pulling back and looking at the daily chart for this pair, the price did break below trend line support last week and is now moving away from the 38.2% retracement of the move up from the March low at the 1.1312 level (the high today was 1.1315). The 1.1218 level is the 50% of the same move higher. It is also near the lows from April at 1.12137-1.1217. That would be the next key target for the pair should the bears keep in control.

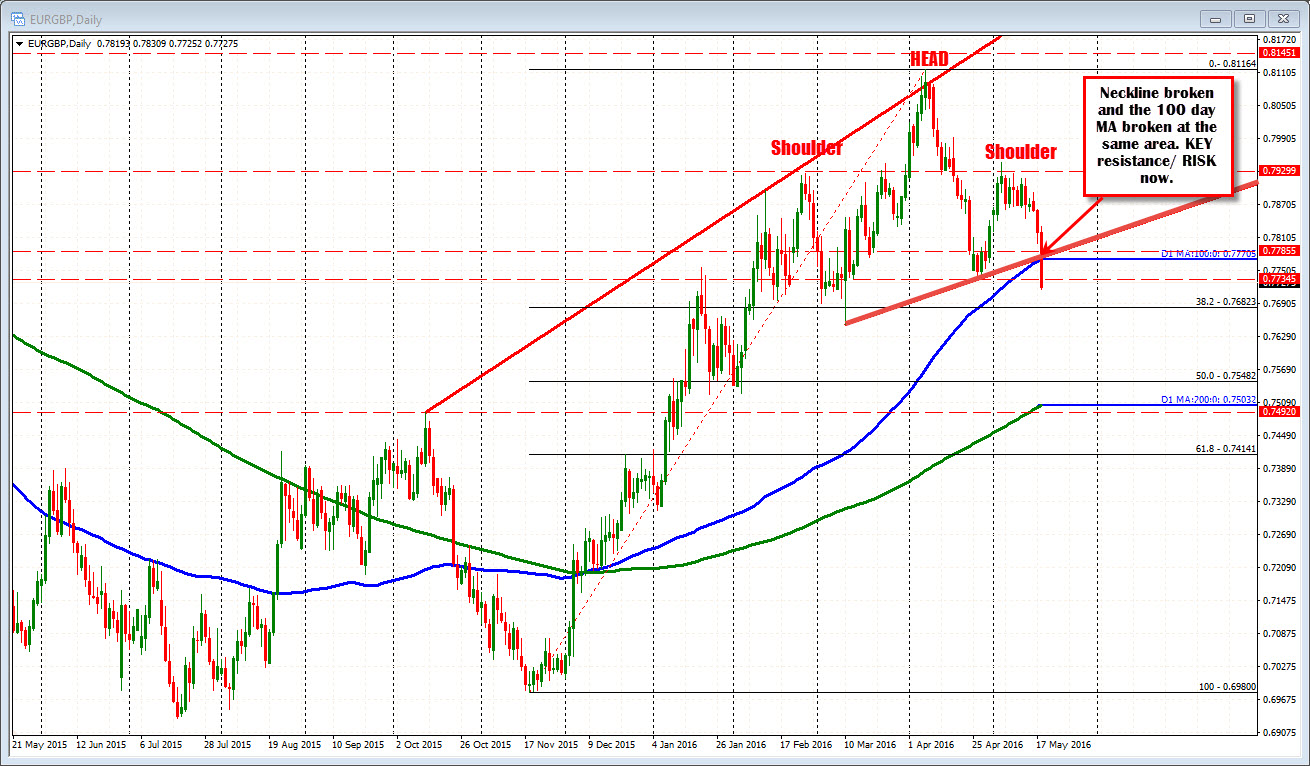

Helping keeping a lid on the EURUSD is the EURGBP. It has broken below the 100 day MA and neckline support from a head and shoulders formation today and trades near low levels for the day. That is a reflection of the GBPs strength and the EURs relative weakness in trading today.