German CPI weaker than expectations.

The German CPI came in weaker than expected for the month of Dec at -0.1% vs. 0.2% estimates. The EURUSD has dipped about 8 pips on the day and trades near London low levels.

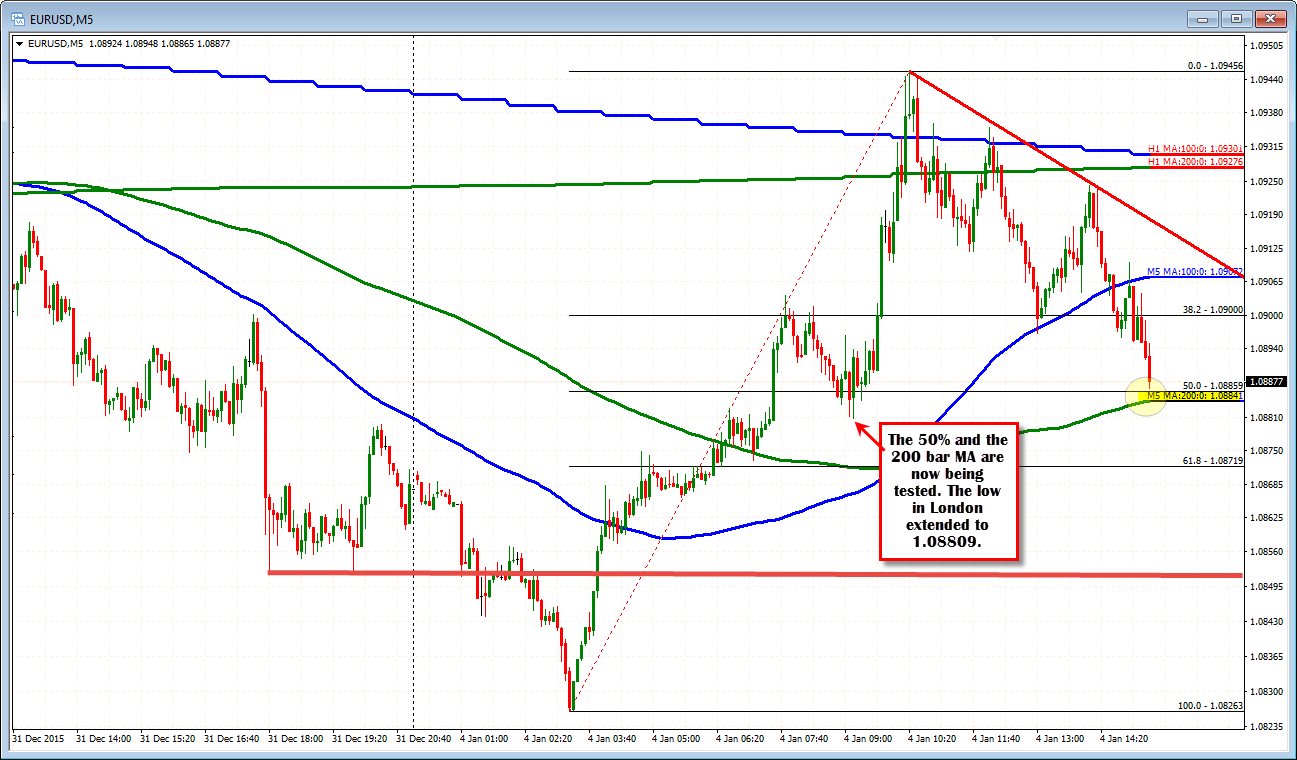

Looking at the hourly chart, the pair rallied higher with lower stocks but found technical sellers near recent highs at the 1.0944 area. That move higher did take the price above the 100 and 200 hour MAs (blue and green lines in the chart above). Those moving averages are nearly touching with the 200 hour moving average at 1.0927 and the 100 hour moving average currently at 1.09303). The fall below those MAs have turned the bias more negative. The first correction higher, sniffed at the level but stalled.

The current price is looking to break below a support area define by swing lows and highs going back to December 15 (breaking now). That area (yellow are in the chart above), comes in between 1.0898 and 1.09029. The recent low just dipped to 1.0895. The market is sitting on another fence right here. Next targets include 1.0884 (50% of the days range and the 200 bar MA on the 5 minute chart - see below) and then 1.0869 which is the swing low from Dec 23 (see chart above). The 2 PM close from Dec 31 was at 1.0868 (bond mkt closed at that time).