Hey...someone who is looking at the data...

Fed's Lockhart weakened the dollar a bit. He actually spoke like a Fed official who is data dependent (just like they said they would be) - citing 1Q GDP that is soft. Some of the other Fed officials say "data dependent" but then argue for higher rates or say April meeting is "live". Whether he is right or not, at least his comments make sense vs the "data dependent" argument. PS unlike the Fed's Beige book yesterday which said car sales were strong (last month was not), inventories were keeping up with sales (they are not), that manufacturing was picking up (-29 and -19K in jobs in the last two months in manufacturing).

The move higher took the price above the close from yesterday at 1.1273. Looking at the hourly chart, that price are was a floor yesterday and a ceiling in trading today. The high extended to 1.1294. The price has wandered back down toward that area currently.

Does the close, old floor and ceiling attract buyers in this area? It should (the price just dipped to 1.12695).

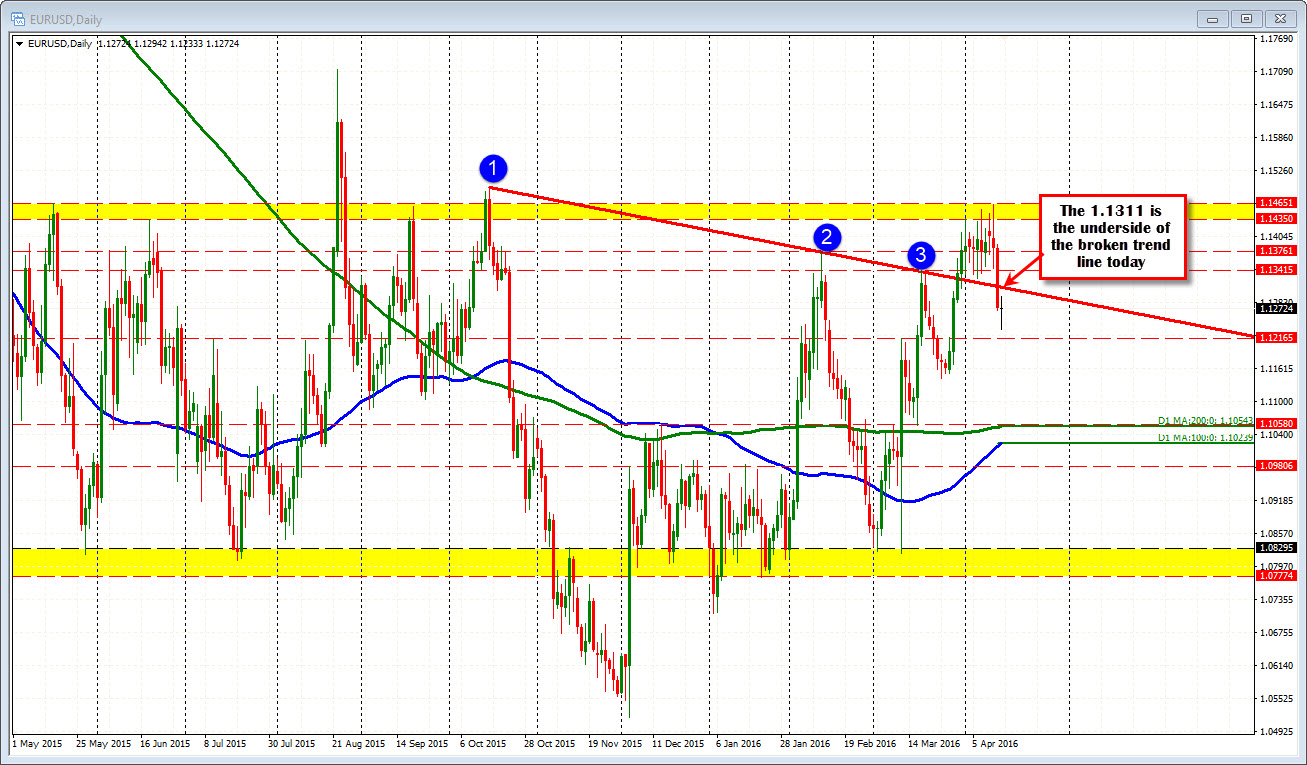

If the buyers do come in and we do go higher, the 1.1304-13 should be tough resistance (see chart above) . The 100 bar MA on the 4-hour chart and 50% of the move up from March 24 is there. Looking at the daily chart the old trend line comes in at 1.1311. The price moved above the line at the end of March- moved up to resistance area (at 1.1435-65) before heading back down on Tuesday and yesterday.

Technically speaking, we can go either way from here. A key technical area where shorts from below may feel inclined to cover, but others may welcome the correction toward higher levels as an opportunity to get in (it could also fail on the rally). So be on alert.