Couldn't break higher. Goes lower. Up on the week. Profit taking before the weekend.

The EURUSD this week bottomed just above the 200 day MA at 1.1048 - the low was 1.1057. That was on Wednesday. Needless to say, the FOMC decision had a say in the the move higher.

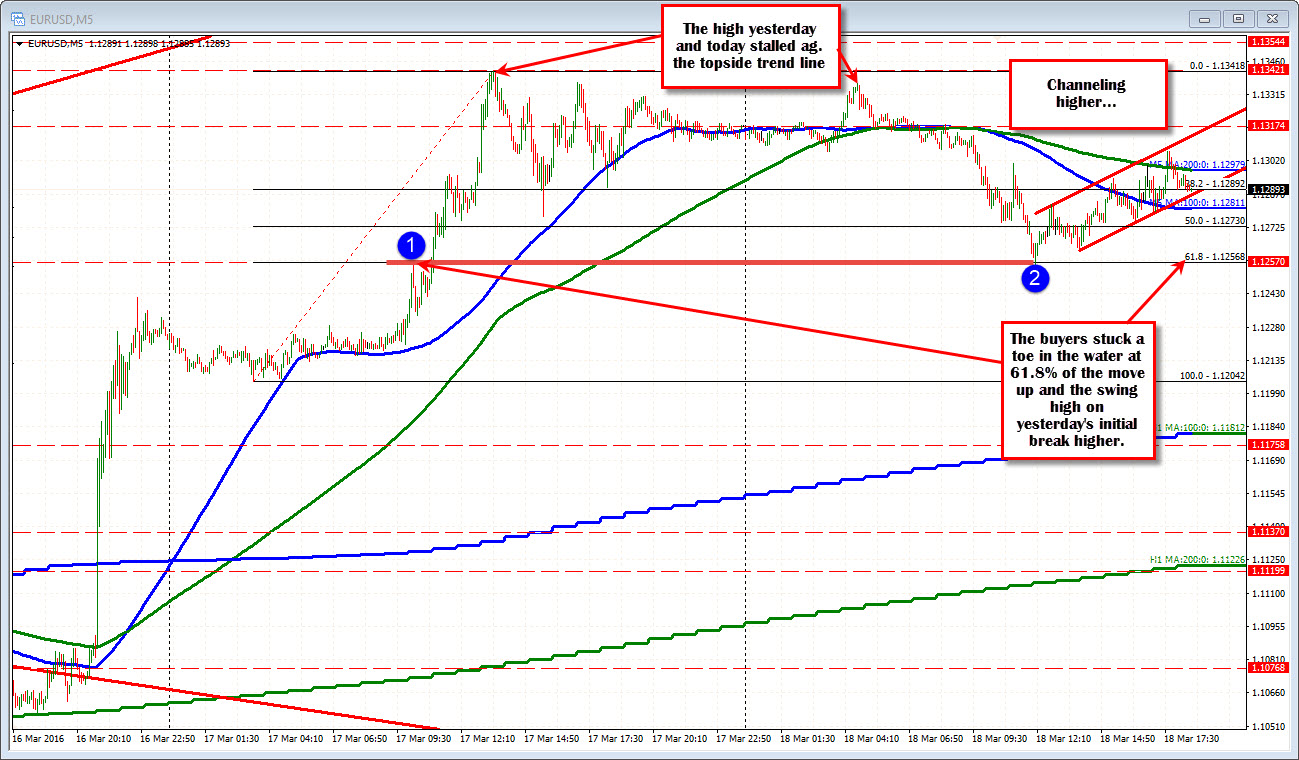

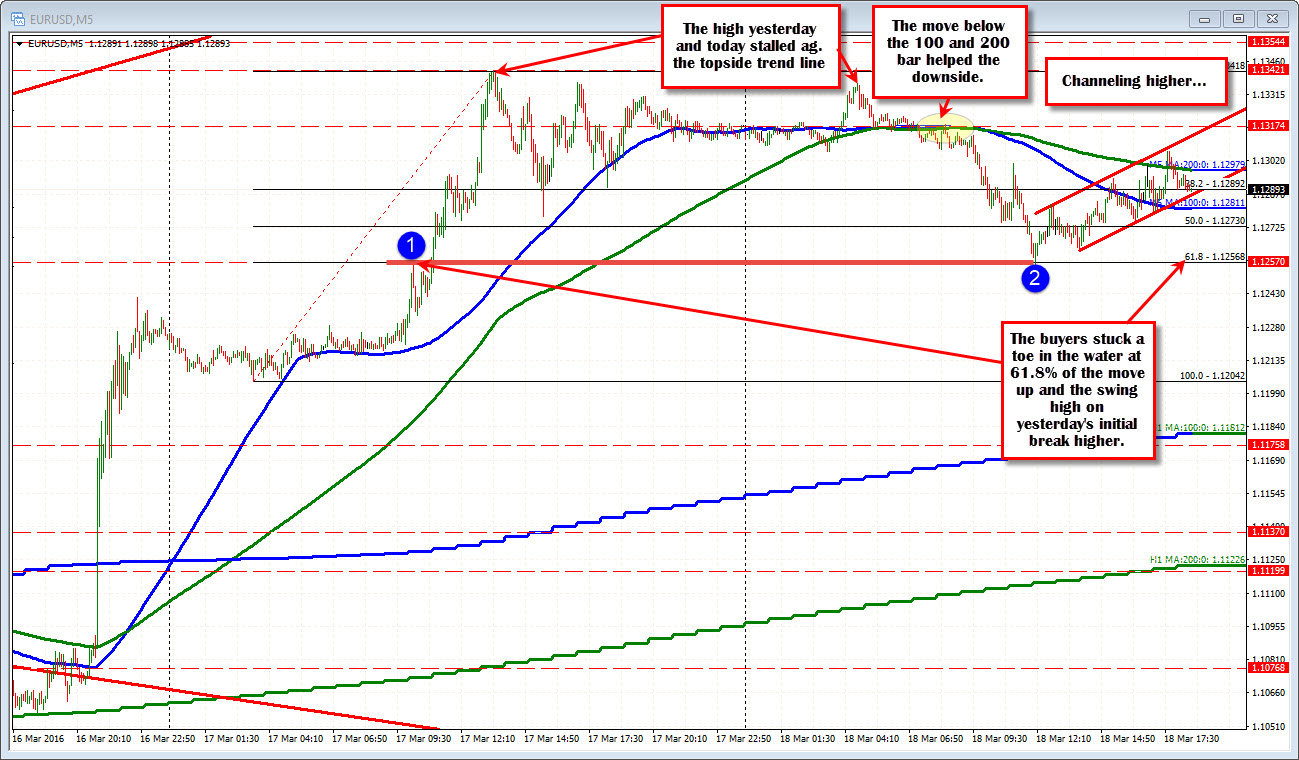

The push to the week's high did stall yesterday against the topside trend line (see video from yesterday here). Today the bulls needed to see that trend line broken. Instead, the price hit the trend line again during the Asian-pacific session. When the high could not be broken, sellers came in, leaned against the level (risk was defined and liimited) and the price started to trade more bearishly.

Looking at the 5- minute chart, the price fell below the 100 and 200 hour MAs and that too helped the corrective action back to the downside (see blue and green lines in the chart below)..

The price is currently trading back lower and is testing the 100 bar MA at 1.1281 area. There may be some support buying, just for a trade, but activity is slowing. The 4 pm fixing is up next. Then the Friday afternoon trading.

Overall this week, it is a positive move higher (last week the pair closed at 1.1146). The topside trend line held above. The 200 day MA held below. So next week it will be more of a battle with defined risk above and defined risk below.