Extends to new day lows

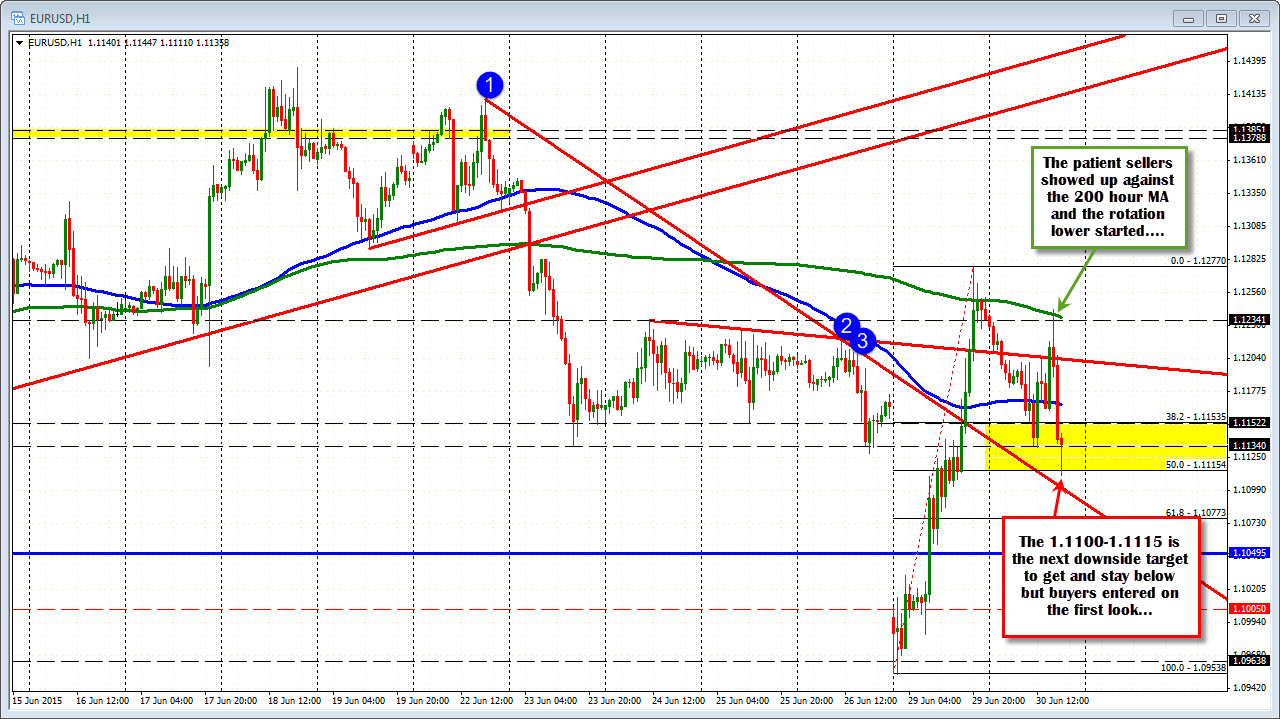

From the earlier post today, the EURUSD rotated higher - giving patient sellers an opportunity to sell against the 200 hour MA (green line in the chart below - see prior post here).

The rotation back to the lows just broke below the support area at the 1.1134 level, and the move has extended toward the next target area at the 50% retracement (at 1.11154 see hourly chart) and the underside of the broken trend line (at the 1.1100 level).

The action occurred right at the fixing time. Yesterday we saw a similar push at the London fixing time (it was to the upside though).

With the price in the "Correction Zone" defined by the 38.2-50% of the move up from yesterday's lows, if the sellers are to take more control, they will need to keep push the price below the yellow area. Shorts will want to see that happen. The dip buyers also have a say down here. It does seem the buyers were happy to stick a bid in against the 50% and the lower trend line. So trading the patient range may still be the play for the day as the market continues to digest all that goes on in Greece and the volatility that it has provided. I would think that a move above the 1.1153 area, and the 100 hour MA (blue line in the chart above) would not be the best scenario for the shorts. It should solicit a more neutral to bullish bias in the up and down action.

Can the sellers keep the pressure on like the buyers did yesterday?