It's not pretty...

If this were a fight, both fighters would be bloody but the buyers would have the edge on rounds.

The EURUSD is up for the 5th of 6 trading days (yesterday's close was 1.13573) but the price action on the 5-minute chart below shows that the sellers are connecting at some points. German ZEW data was weaker (VW). There are calls for more QE in December by a few investment banks. The GBPUSD tumble may have had a downward influence. Feds Brainard muddied the water for the Fed earlier (more dollar bearish)..

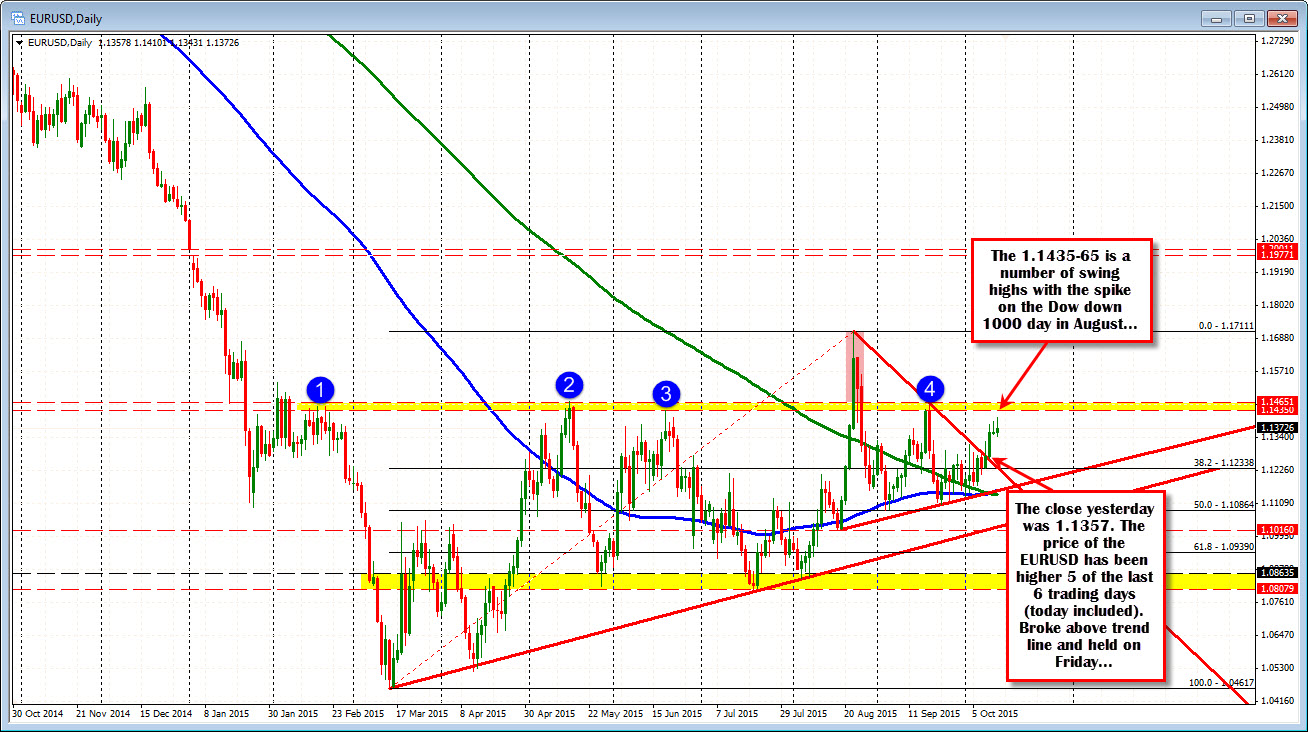

Technically, the pair moved above trend line resistance on Friday and has kept above (see daily chart above). The pair is getting closer to the majority of the swing highs seen since Feb at the 1.1435-65 area. This will be a tough nut to crack on a test. In August the pair surged higher on the back of the Dow down 1000 day.

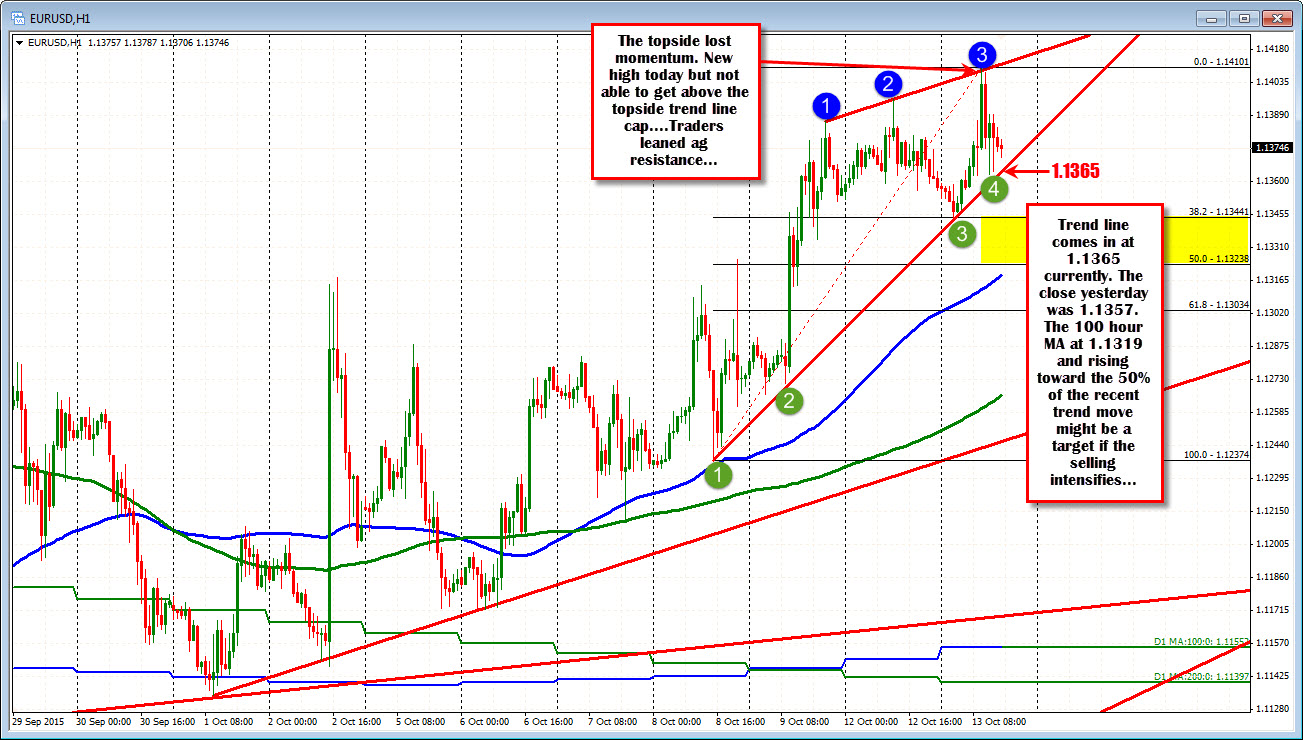

Looking at the hourly chart below, the pair on the topside, found sellers swinging away against the topside lid (see blue circle 3 at 1.1410). The key resistance from the daily starting at 1.1435 was not really sniffed.

The subsequent move lower off that level has traders pondering the lower upward sloping trend line at 1.1365 and the close at 1.1357. Is this the level for the buyers to swing away and throw some bullish punches in the up and down market? Risk is defined, but the range is still narrow at 67 pips for the day. On a break lower, the gravity should lead toward a test of the 100 hour MA and 50% of the last move higher at the 1.1324 area.

Right now, we are seeing some jabs by the buyers against the lower trend line. The sellers are more bloody but the buyers are feeling a bit light on the feet too. The fight continues in the middle of the ring. For you....Look to be patient and take your trading swings near extremes or on breaks. And remember there is some room to roam on breaks....