The weeks weak trading range extended.

The EURUSD trading range for the week was only a weak 78 pips before the better than expected US CPI data. That has now been extended after the data.

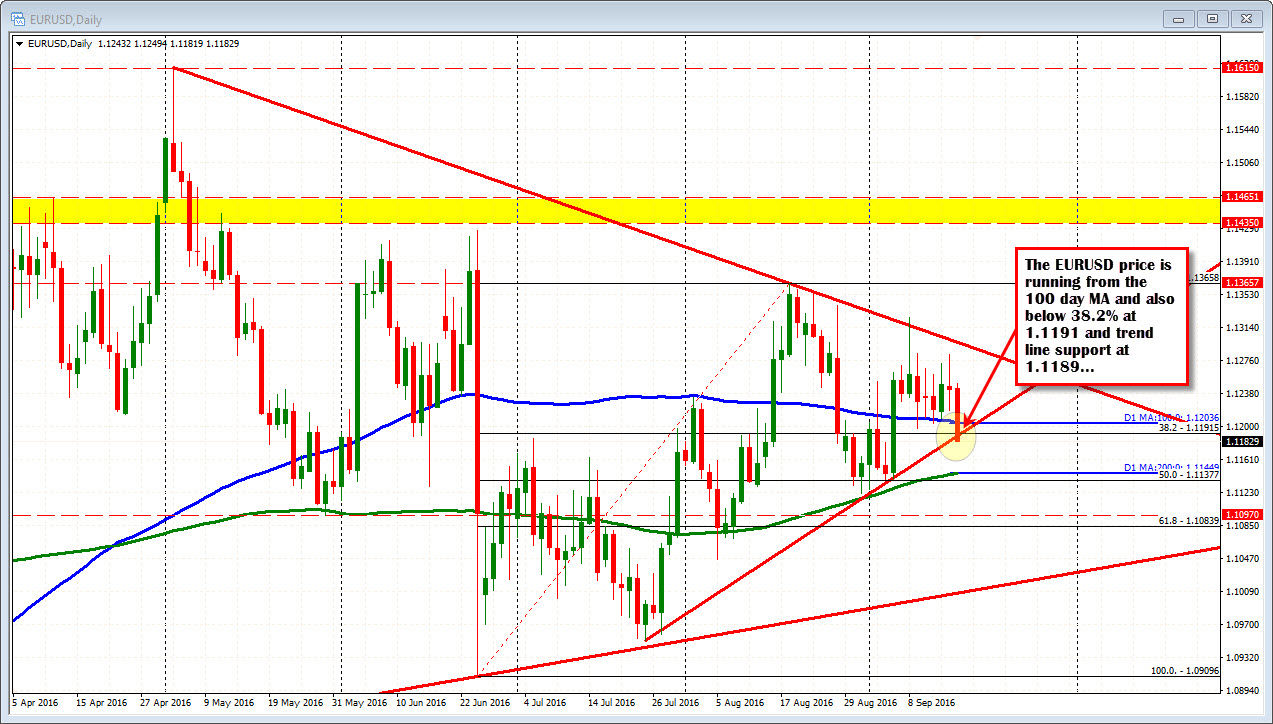

The pair is also running away from the 100 day MA at the 1.12037 level. and trades at the 1.1180 as I type. Looking at the daily chart above the pair has also moved below the 38.2% of the move up from the post-Brexit low and a trend line connecting the low from July and early August (at 1.1188-91). The next major target on the daily chart comes in at the 200 day MA at the 1.11449 level. The price for the EURUSD got close to it at the end of July/early August but early buyers against the risk defining level, kept the pair supported.

Drilling in the hourly chart, the price is approaching a trend line connecting the lows going back to the end of August. That comes in at 1.1178. A break of it opens the door for a run to the 200 day MA.

The low trading range for a week in the EURUSD in 2016 is about 125 pips. That would target 1.1157. That is to just get to the lowest range. So there is room to roam (and the 200 day MA is doable).