Yesterday, the level held. Today? Nope.

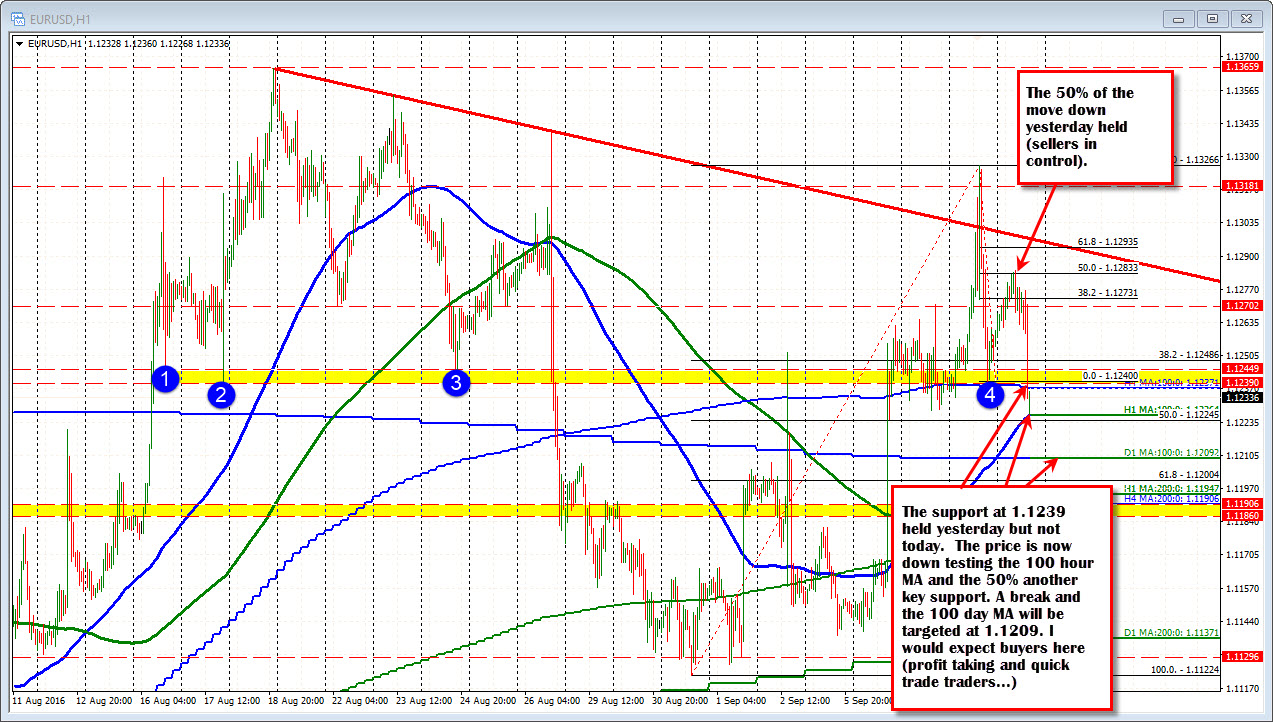

The EURUSD did a big lap in trading yesterday with the price moving sharply higher and then sharply lower. The low yesterday bottomed right at support against the 100 bar MA on the 4 hour chart at 1.1239. The area also corresponded with swing lows from August (between 1.1239-45).

Today the price has broken below the area as traders push the dollar higher (the EURUSD lower). Contributing to the bearishness technically, is the fact that earlier today, the 50% of the move down yesterday held resistance. Sellers remained in control. That - coupled with Feds Rosengren's more bearish comments - has traders saying "Ole" at the support level from a day ago. The pair is now testing the 100 hour MA and 50% of the move up from the August 30 low. This is another key bearish test area (1.1224-26) that is stalling the fall - at least for the time being. Traders short want to see that level broken. They also would love to see the 1.1239-45 hold resistance. That is the battle that is being waged now.

Traders are probing to see how much can be taken to the downside. Those traders probed the upside yesterday and were able to make it above a resistance area at 1.1318 for a brief moment before moving back lower.

With the market largely moving up and then moving down, there tends to be a number of technical levels to target. If this 1.1224 level can be broken, the 100 day MA comes in at 1.1209. I would expect the shorts to buy against that level on a test (patient buyers be aware). The move off the level might just be back up to the 100 hour MA, but it nevertheless should provide a take profit level for shorts and a quick low risk Friday trade for longs (stops below of course).

Resistance now at 1.1239-45 area.