..but more work to be done

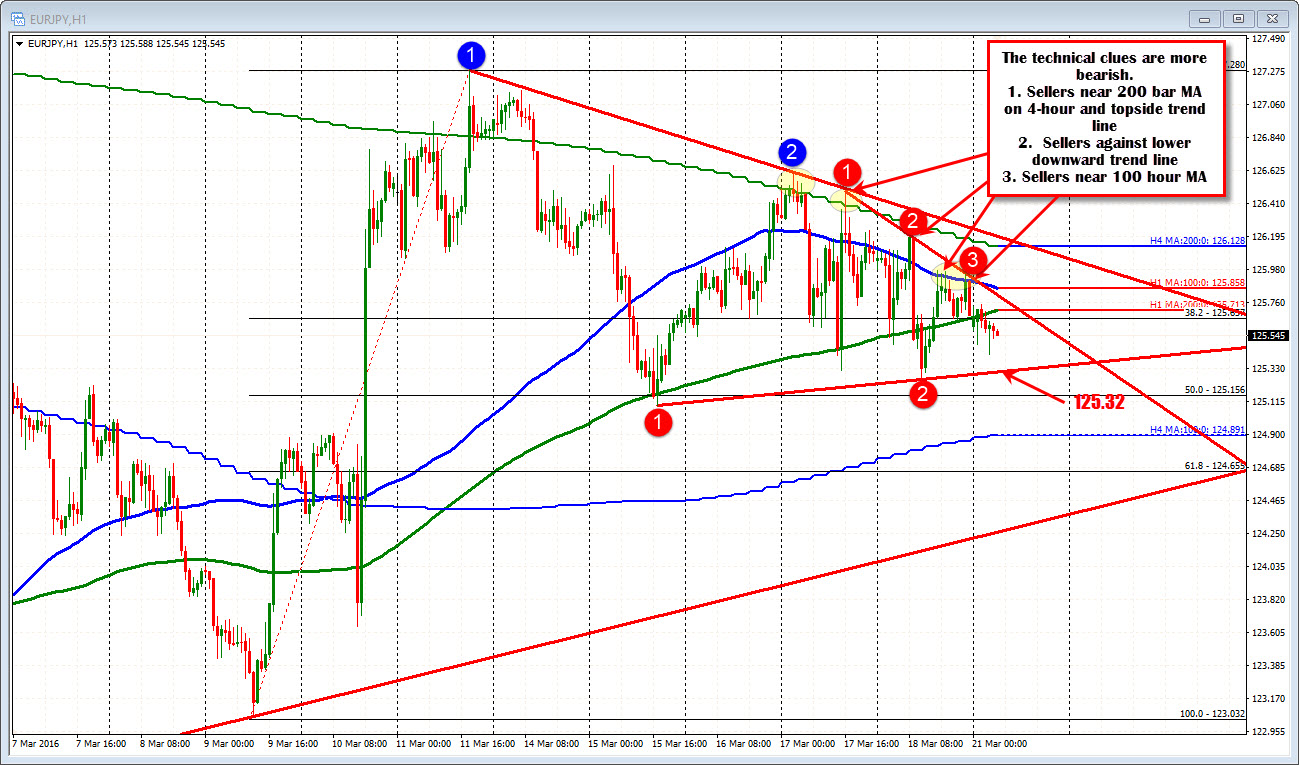

The EURJPY over the last few days has tested a topside trend line and 200 bar MA on the 4-hour chart (green step overlay on the below chart). It has formed a lower trend line and held that line on Friday's trade. On Friday the 100 hour MA (blue line in the chart below), held resistance. Today, the 200 hour MA has been breached with most of the action today below the line. The same can be said for the 38.2% retracement level. All those are bearish for the pair.

Having said that, the move from the high on Thursday to the low on Friday has only been about 135 pips. So the sellers are not exactly lighting the world on fire. They do dominate the bias below the aforementioned technical levels. Risk is 125.85 area now - i.e. below trend line and 100 hour MA. If you want to shorten that up given the non-trending market, the 200 hour MA at 125 71 could be used.

What work needs to be done to get the ball to the downside moving more?

A move below the lower trend line at 125.32 is step one. Step two is to get and stay below the 50% retracement of the move up from the March 8th low. That level comes in at 125.156. The low last week dipped below the 50% (and the 200 hour MA at the same time) but could not sustain ANY momentum. That is the key level for me as a result.

Sellers in charge (below 125.85). A move below 125.15 is good news for the bears.