200 hour MA and 50% broken

Ryan did a earlier post on the AUDUSD. He commented how the AUDUSD was being pressured by declining iron ore prices (lowest levels since 2009). Technically, he also pointed out how the pair reached a short term technical level on Friday, against the 38.2% of the move down from the May high at the 0.7083 area. That move also corresponded with the high from from October. The level held and a move down was started

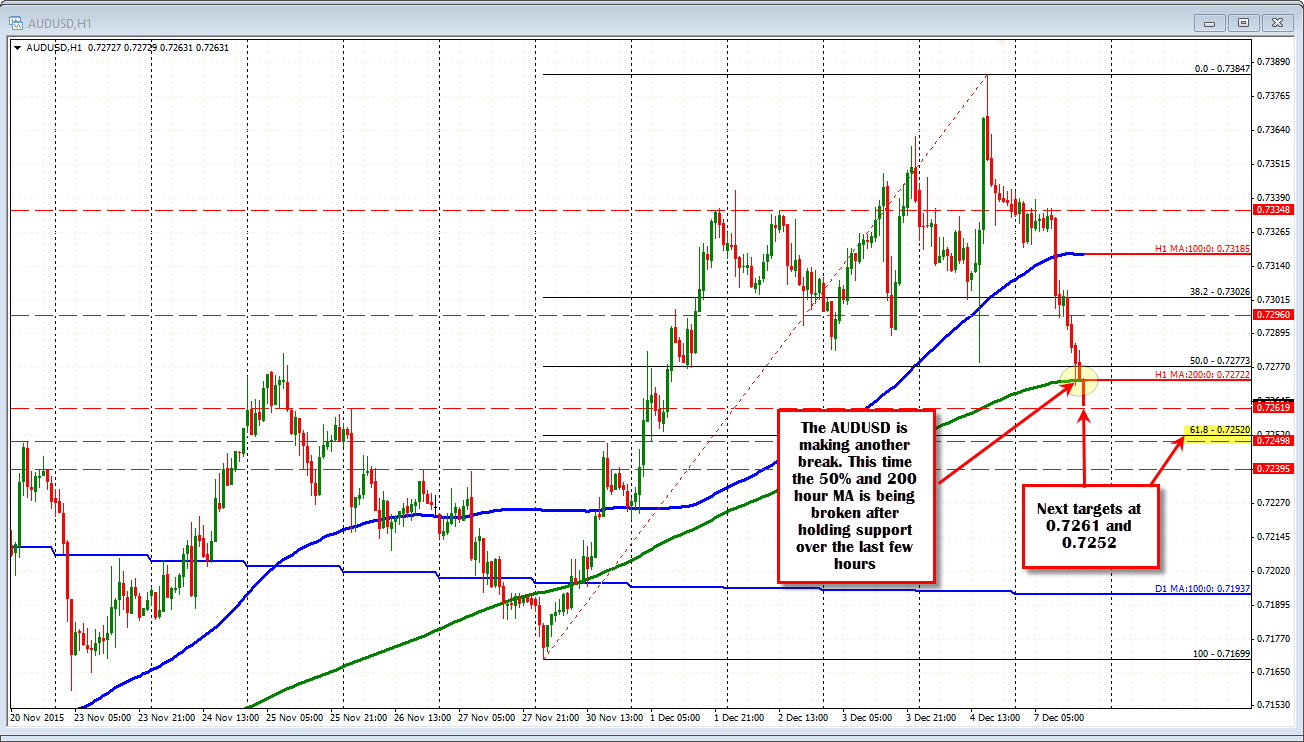

The accelerated move lower today has seen the price move below the 100 hour MA (blue line in the chart below) and is now making a run below the 200 hour MA (green line in the chart below). That level comes in at 0.7272. Also near the area is the 50% of the move up from the November 30 low at the 0.7277.

The price tested and held support against these two levels over the last few hours of trading. However, the correction higher was modest (at best). If the price cannot bounce off a pretty good technical level, you can expect stops on a break. That is what we are seeing. The next targets are the 0.7261 (breaking as I type) and the 61.8% at the 0.7252. Below that 0.7239.

The bearish bias is accelerating. Risk is now against the 200 hour MA and 50% for shorts.

Fundamentally, the RBA ignored the commodity price fall in statement last week, but the market is now thinking that the patience may not last for much longer. Watch for sellers to lean against the aforementioned resistance.