Rate decision at 12:30 AM ET/0430 GMT

The RBA is expected to keep rates unchanged when they announce announce there rate decision at 12:30 AM ET/0430 GMT on Tuesday.

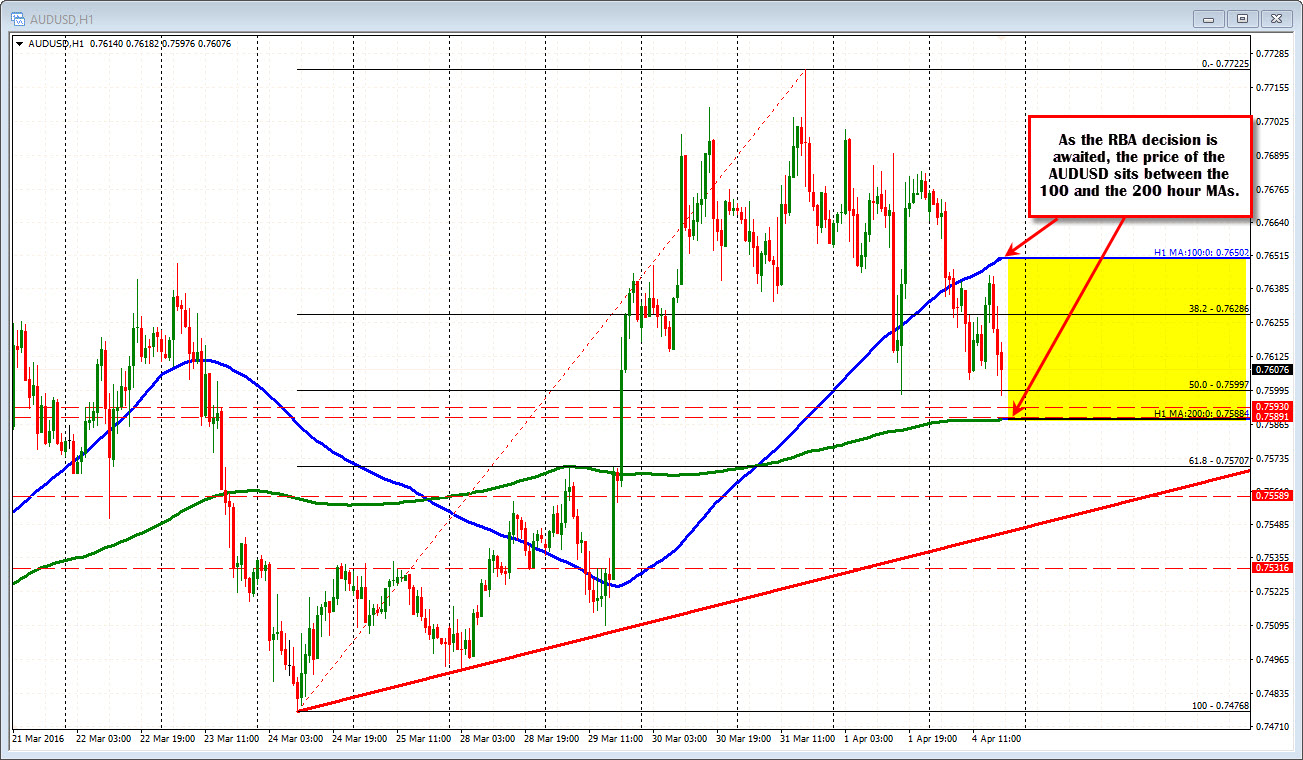

The AUDUSD has moved lower before that decision in trading today and in fact made new lows in the last hour. The pair is testing the 50% of the move up from the March 24 low at the 0.75996 level and the low from Friday (at 0.7598 before surging back higher). The next target is not far away at the 200 hour MA at the 0.7588 level (green line in the chart above).

Fundamentally, the expectations are that the RBA keeps rates unchanged but softens their tone. If there is a surprise, there will be a cut. The AUDUSD moved up from 0.7100 to 0.7700 in March (currently at 0.7600). The AUD has also appreciated against the EUR and the JPY. Commodity prices did rise in March but the CRB index has move back down in the last few weeks of trading and most expect that the upside is limited. Retail sales were weaker last night. Trade data will be released later (9:30 PM ET/0130 GMT) tonight with expectations of a -2.55B deficit. Does the RBA and Stevens want to see the AUD continue to rally and worsen the terms of trade? I would not think so.

Nevertheless, we know anything can happen.

So what are the key technical levels?

Looking at the hourly chart, the pair sits between the 100 and 200 hour MAs (blue and green line in the chart above). The 100 hour MA is at 0.7650.The 200 hour MA is at 0.7588. The price is also trading near the midpoint of the move up from March 24. So on the surface the pair seems to be more neutral with traders are waiting for a break.

However, today's price action gives more of a bearish view. The price tested then moved back below the 100 hour MA. The correction off the low, stalled under that MA line AND also stalled at the midpoint of the move down from the late Friday high (see 5 minute chart below).

As a result, I would expect that the sellers will help keep a lid on any rallies between now and decision time. Watch the 0.7628 level to be close resistance now (38.2% of the move up from March 24 low (see chart above). The 200 bar MA on the 5-minute chart may also be a risk defining level for traders to lean against.