No change expected. Decision due at 10:30 PM ET, 0330 GMT.

The RBA rate decision is due out at 10:30 PM ET/0330 GMT (today/tomorrow). The expectations are for no change in policy.

Technically, the pair is sitting at a comfort level - I guess not surprisingly given the expectations. That is right at the 100 day MA (blue line in the chart above). Note the MA is going sideways. The price has been moving up and down over the last 7 months. The midpoint is at at 0.71039. The low today moved to 0.7108 - just above that midpoint. I would say, the market is content. It may be even getting ready for a nap.

Looking at the daily chart above, the pair is converging between an upward sloping trend line below, and a downward sloping trend line above. If the price is going lower, a break of the lower trend line near 0.7103 will be eyed. That also corresponds with the 50% of the recent trading range. Needless to say, that will be a key technical level to get below - and stay below - on a more dovish statement and if the market wants to take the pair back toward the 7-month lows.

On the topside, there is more room to roam until the topside trend line is breached. That line comes in at 0.7244. The 200 day MA is also a key, key, key level. The price of the AUDUSD has not traded above the 200 day MA (currently at 0.72639) since September 11 2014. A break above that 200 day MA SHOULD solicit more buying but the recent double top at 0.7381 becomes a key target.

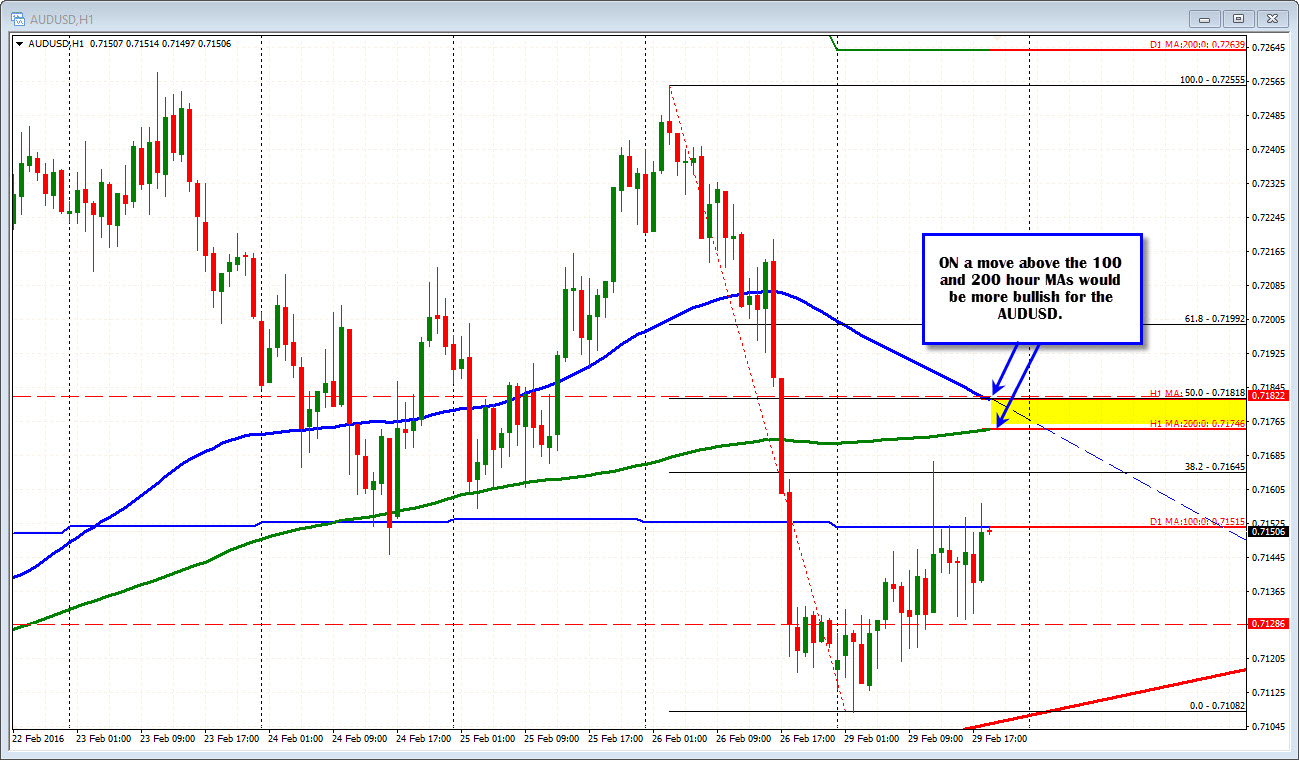

Looking at the hourly chart, there is closer upside targets against the 200 and 100 hour MA (Green and blue lines in the chart below). The 200 hour MA is at 0.71745. while the 100 hour MA is at 0.71818 (but is moving lower). Technically, a move above those MA lines - and staying above - will give more of a bullish bias to the pair.