RBA cuts, but AUDUSD squeezing shorts.

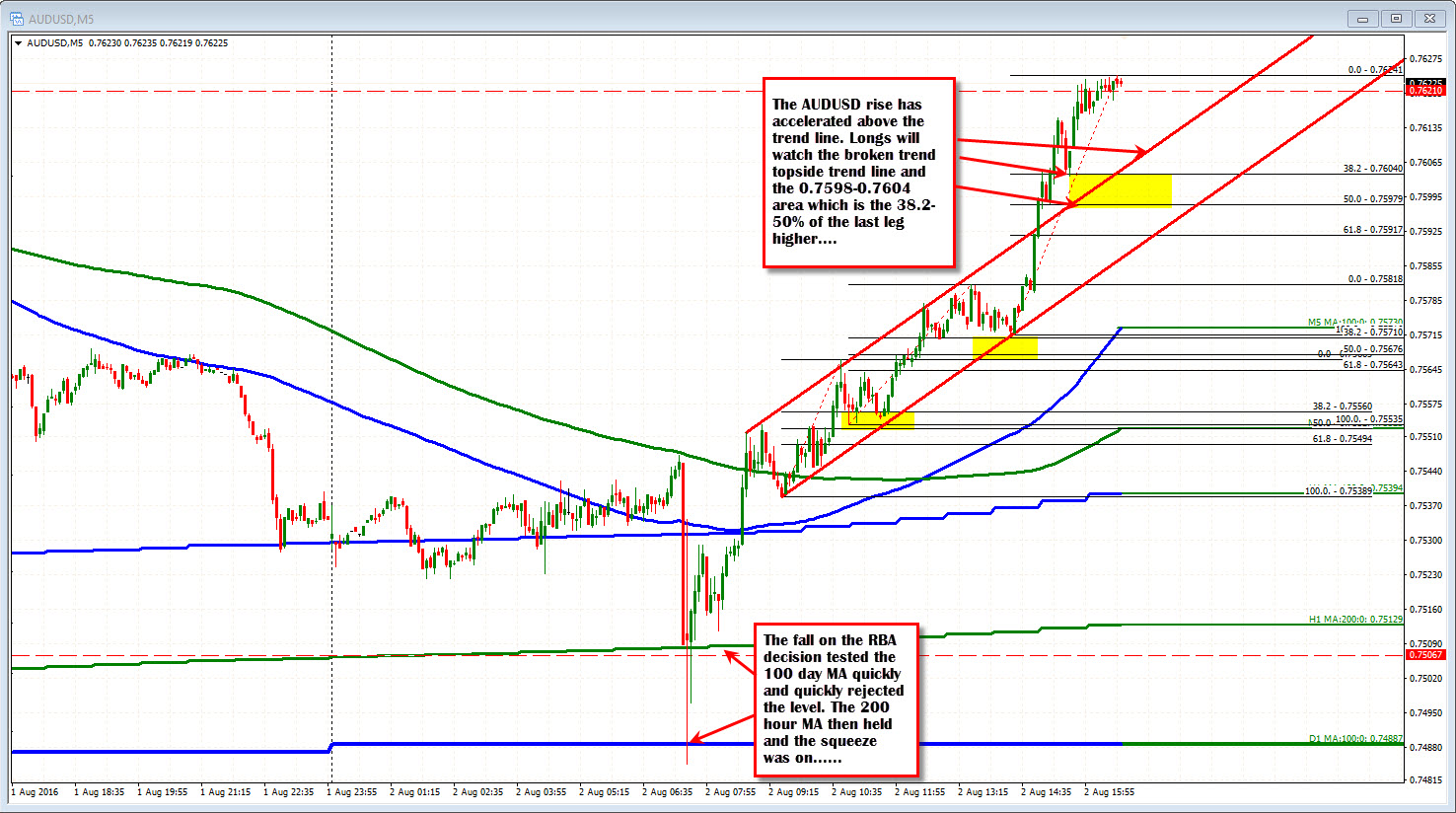

The AUDUSD continues to squeeze higher despite the cut by the RBA earlier today. The fall after the cut held support near the 100 day MA (lower blue line in the chart below). After bouncing off that level and holding above the 200 hour MA (green lower line in chart below), the squeeze higher was on.

Looking at the chart above the pair has stepped higher in the trend move. The "legs" higher have been able to stay above the 38.2-50% correction zones defined by the yellow areas in the chart. The current leg higher which runs from 0.7571 to the recent high, has the 38.2--50% above and below the 0.7600 level. This is now support/risk for longs. In the last price surge higher, the price has moved above the topside channel trend line. That too will be eyed as support for the longs.

Fancy a short?

Be careful, squeezes are squeezes because traders continue to sell and they don't go down. However, the 0.7630 was the high close going back to early May. Above that, the high from June 23 at 0.7645 and then the high from July at 0.7675 are the next levels I see. Traders trying to pick a top can lean and then look for the aforementioned support levels to give way for more confidence a top is in place. If the price continues to go higher instead, get out. The trend can continue. After all, the squeeze is on.

PS Sorry Ryan... Stomped on you again (5 seconds this time).....