RBA decision eyed later in the week.

The AUDUSD is starting the week with some early weakness. Like many pairs, Friday saw the pair surge higher and the price ended trading on Friday above the 100 day MA (today at 0.7364 area).

The high reached 0.7368. There is other topside resistance against the 0.7381-84 where swing highs from October 2015 and December 2015 stick out. The pair raced above that area in March this year and moved back below in May. The AUDUSD has closed below the level since May 6th (see daily chart below). Traders will likely lean against the MA level with risk defined and risk limited.

The RBA will announce their interest rate decision later this week (Tuesday at 12:30 AM ET/0430 GMT) with the expectation for no change. At the May meeting, the RBA cut rates by 25 basis points, and the move sent the pair down from the 0.7700 level to the low for the month at 0.71446. With the 100 day MA looming above (and other key resistance not far above that at 0.7384), the upside might find things difficult before the RBA decision.

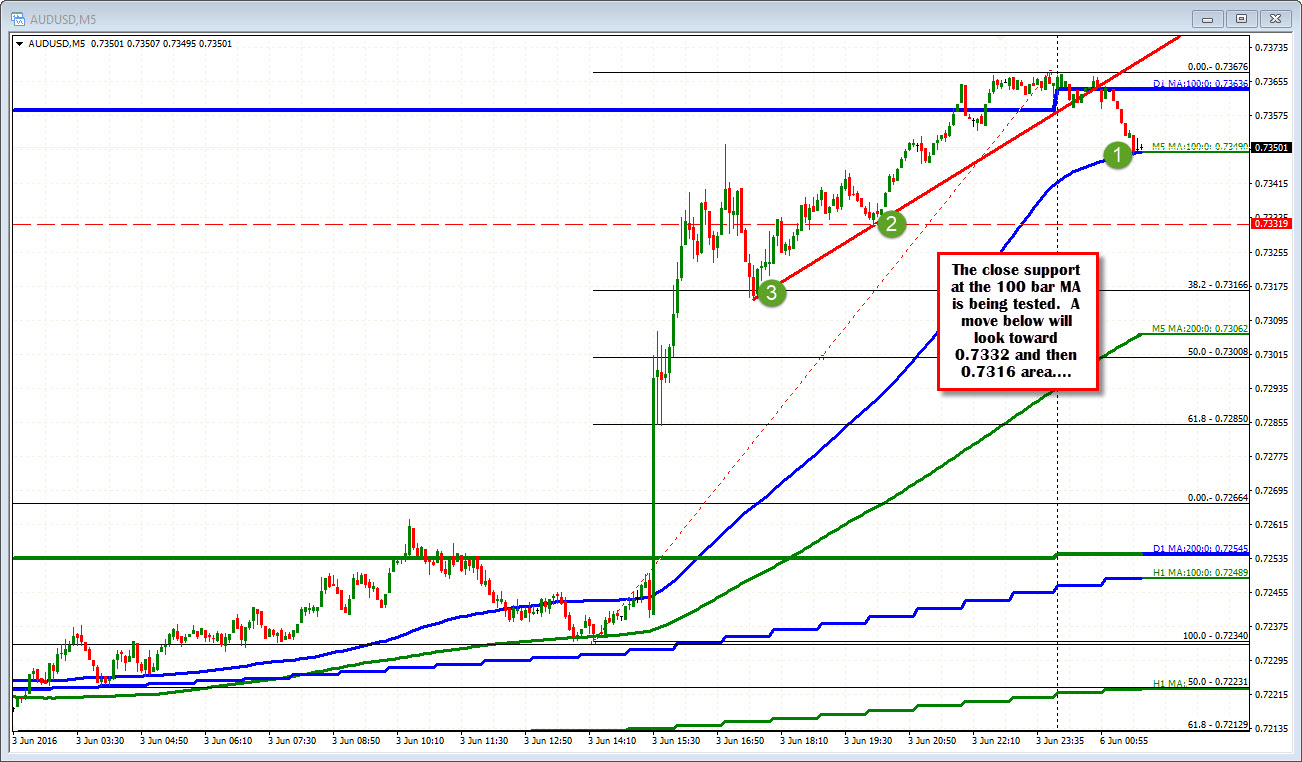

Looking more near term at the 5 minute chart, the pair is testing close support against the 100 bar MA (blue line) and slowing up a little against that level. The market may do a little "rope a dope" against the level for intraday scalpers. A move below will look toward 0.7332 and 0.7316 (50% of the trend move higher on Friday and near a low correction point as well - see chart below) where there should be better support.

A new week takes some of the sting away from the US solely. Although the RBA is not expected to do anything, traders will likely trade more cautiously before the meeting decision.

We do get some data later with the MI Inflation Gauge and ANZ job advertisement.