Forex news for March 6, 2015 US edition:

- February 2015 US non farm payrolls 295k vs 240k exp.

- US Feb average hourly earnings 0.1% vs 0.2% m/m exp

- Canada Q4 labour productivity -0.1% vs 0.0% expected

- Canada Merchandise Trade -2.45B vs. -1.00B estimate

- US Trade Balance -41.8B vs -41.1B estimate

- Hilsenrath: No guarantee the Fed moves by midyear

- Baker Hughes rig count 1192 vs 1267 prior

- Richmond Fed President Lacker says jobs market has moved at a greater pace than expected

- Fed's Fisher: Wage prices pressures are still so far pretty tame

- US January consumer credit $11.56B vs $14.75B expected

- CFTC Commitments of Traders data

- Gold down $31 to $1166, lowest of 2015

- WTI crude down $1.06 to $49.69

- US 10-year yields up 13 bps to 2.25%

- S&P 500 down 30 points to 2071

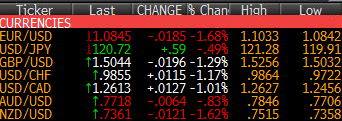

- On the day, USD leads, EUR lags

- On the week, USD leads; EUR and CHF lag

The market probably was looking for something worse than the 'expected' consensus because of poor weather. The jobs report wasn't really that great with the revisions and soft wage growth but the market had one thing on its mind -- buying US dollars. The dollar was shot out of a cannon on the numbers and continued to rip higher.

EUR/USD is in a no-man's land of support and could hardly muster a bounce. On the day, it fell almost 200 pips to 1.0844 and closed near the lows. All the bounces were less than 40 pips.

Cable had its worst day in Mondays and has now virtually erased the more-than five cent rally in February in just five trading days in March. It's not really about the pound, just that the dollar is on fire.

The Canadian dollar was hard hit but weak trade numbers. It's fanciful to think that manufacturers are going to start moving to Canada just because of a weaker currency. Still, the loonie was the second-best performer this week, it just doesn't look good versus USD. Last at 1.2611.

The Australian dollar closes at a three week low near 0.7718. The RBA was supposed to be the saving grace for the Aussie but nothing can save it from the bulldozer that's the US dollar.

Gold took a beating on rate hike expectations. Out to 2016, the futures market priced in an additional half-hike but that was enough to break the back of the gold (and bond) market.

Overall, it was yet another big day for the US dollar and another 11-year low for the euro. I think it's overdone and I like the chance of a bounce on Monday, especially in cable.

Have a great weekend, if you missed the European wrap earlier, here it is.