Forex news for March 4, 2015: US edition

- Bank of Canada holds rates at 0.75%

- BOC says inflation risks are 'now more balanced'

- Full text of the Bank of Canada rate decision

- February 2015 US ISM non-manufacturing PMI 56.9 vs 56.5 exp

- February 2015 US ADP employment report 212k vs 220k exp

- Beige Book: Wage pressures were moderate, limited to skilled jobs

- Feb final Markit US services PMI 57.1 vs 57.0 exp

- Evans calls for Fed patience and no rate hikes until 2016

- Report: Swiss finance minister wants new EUR/CHF floor

- Swiss govt spokesman denies EUR/CHF floor report

- Merkel says there will be no 3rd Greek bailout while their hands are full on 2nd one

- US EIA weekly oil inventories 10303K vs 3887K expected

- Fed releases 2009 transcripts

- George: Supports raising Fed funds rate by mid-year

- Iran nuclear deal very, very close: foreign minister

- Gold up $1 to $1201

- WTI crude up $1.08 to $51.60

- S&P 500 down 9 points to 2098

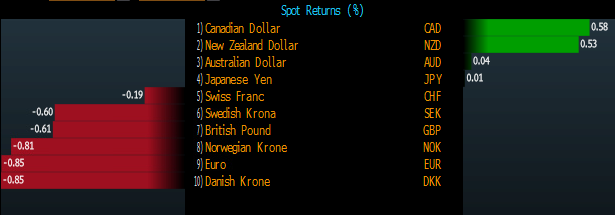

- CAD leads, EUR lags

The Canadian dollar surged (USD/CAD down) after the Bank of Canada opted to hold rates. Policymakers also took a decidedly neutral stance. The fast money trade was squeezed a bit ahead of the decision as USD/CAD moved to a high of 1.2542 just before the announcement. The inital move was 80 pips lower, followed by a 40 pip bounce. It was that kind of back-and-forth all day but there was an undercurrent of real money selling in USD/CAD and it finished at 1.2423. There is good support down to 1.2350 but it could be a quick fall if it goes any lower.

The euro might have stolen the show as it slid below the January low of 1.1098 to an 11-year low. The low of the day was 1.1061 and, importantly, it closed below 1.1100. The technical picture doesn't look good.

The bigger theme was US dollar strength in NY trading as cable also took a tumble to below 50% of the Feb rally. After falling below 1.5320 it was a quick slide down to 1.5260.

The Australian dollar was also caught in the rout as it reversed down to 0.7820 from 0.7860 just when it looked like the bulls were starting to get the upper hand. Anyone long since the RBA has to be frustrated by the lack up upside.

Only JPY kept pace with the US dollar and largely because there was a deeply risk-off tone in the early going. The S&P 500 fell by 20 points at the lows and that kept USD/JPY in a 119.50-80 range.