Yes folks the F0MC previews just keep on coming, courtesy of efxnews.com

Here's the thoughts of Nomura

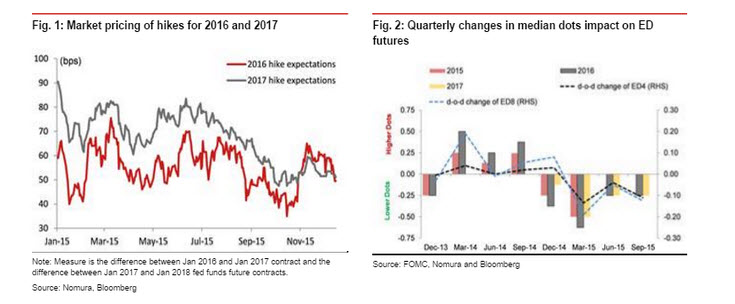

"We think dots will come down, although more so in 2017 and 2018, than in 2016. In the past, dots moving lower have been bullish for rates and negative for the dollar. But this time may be different. We are talking about actual lift-off, and the levels of dots should start to matter more and more (vs changes)

We don't think 2016 Eurodollar contracts have any real room to rally, and even for 2017 and 2018 the potential seems fairly limited. In other words, it will be hard to deliver a dovish hike, and rates, especially 2016, may indeed sell off. In addition to the signal on future rates, 'risk sentiment' is a key parameter. Risk assets have been stabilizing on Tuesday and may benefit from reduction in uncertainty tomorrow," Nomura projects.

Bottom line for currencies:

"We don't think the Fed will be able to generate a hike that is sufficiently dovish to move rate expectations down meaningfully. This is almost certainly the case for 2016 expectations, given current pricing. For 2017 and 2018 expectations, it is more tricky; median dots may move down meaningfully. But even for the out years, we do not expect a market impact similar to previous dot changes (i.e., market rates will be less sensitive to dot changes, and respond more to levels).

What may end up being the crucial market driver is the "risk sentiment" effect. On this front, there is some evidence that risk aversion may have climaxed in the near term. We also note that there has been a pattern of relaxation around important Fed events in the past, and this could be the case again.

If the Fed delivers a neutral hike, it may indeed be supportive for risk assets in the near term, and we could see a divergence between USD/G3 (higher) and USD/EM (lower),"