Goldman Sachs makes the case for higher wage inflation

1) Alternative wage indicators remain strong

While the official measure of wage growth (Average Weekly Earnings growth) has slowed recently, various more timely survey data (Exhibit 1) have showed little or no sign of slowing wage momentum.

They cite data from the BCC Quarterly Economic Survey, XpertHR and Vocalink but note that the REC survey is a leading indicator and it has softened.

2) More stable hours worked

Part of the reason for the softness in take-hope may simply be fewer hours worked.

"Over the coming year, we expect average hours to stabilise - as does the Bank," Goldman Sachs says.

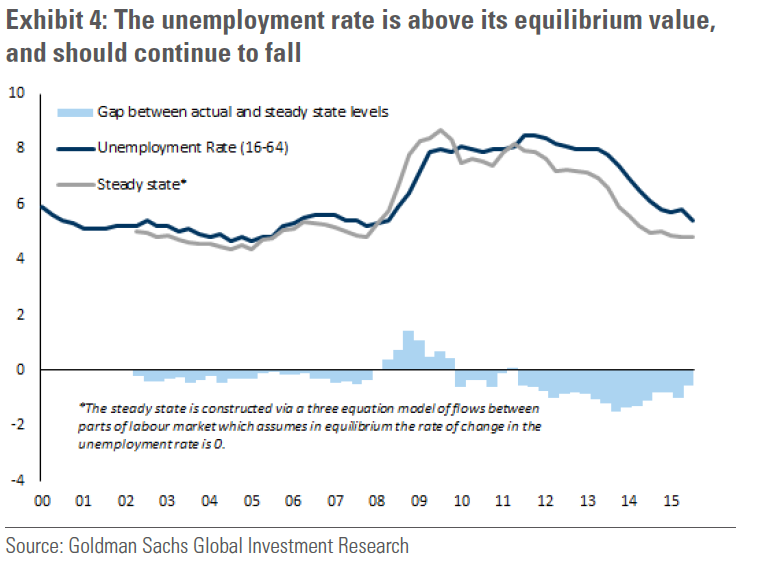

3) A tighter labour market

Since the start of January 2015, the unemployment has fallen 0.4 percentage points. They see the 'steady state' of unemployment at 4.8% compared to 5.4% currently.

"Given that the UK labour market seems to have moved to a steeper part of the Phillips Curve in 2015, the expected falls in unemployment in coming months should translate into support for wage growth."

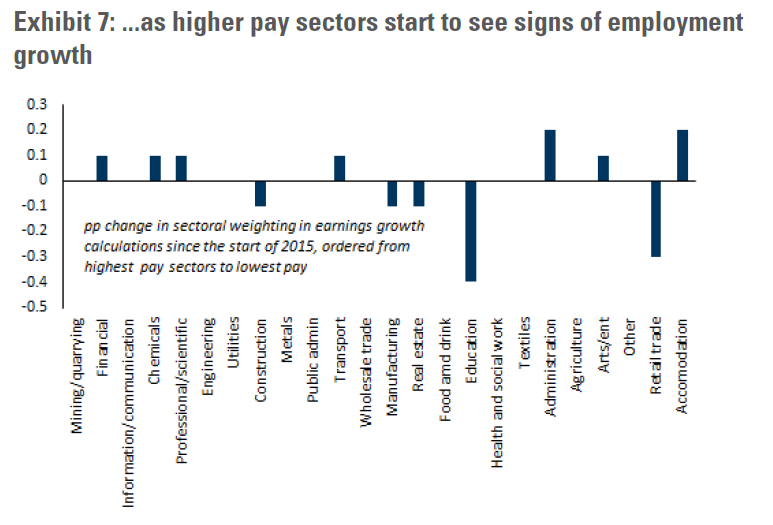

4) Changing composition of the labour market

One of the reasons for perceived lower wage growth is that hires have been in low wage sectors like retail while the financial sector has struggled. That began to reverse in 2015 and will continue to do so, Goldman Sachs says.

5) Better productivity

"Based on the assumptions in our forecast, and compared with the non-existent productivity growth seen in 2014, we expect productivity over 2015 and 2016 to pick up, although not quite to historical average growth rates. That said, the 'wedge' between productivity and production

deflated real wages4. suggests that the relationship between productivity and the real wage may have weakened since 2009," Goldman writes.

They say the main risk to their forecast is pass-through from a persistently low inflation environment.