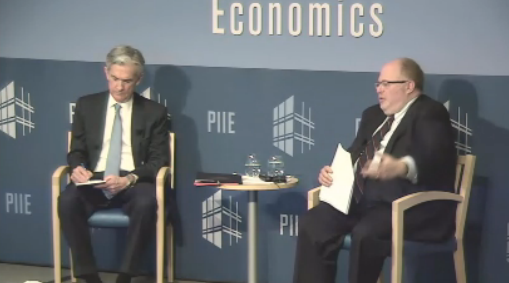

Powell takes audience questions at the Peterson Institute:

- Companies can cut costs, buy back stock and 'meet numbers' without risk

- Over time that leads you towards a hollowed out economy

- Since mid-2014 financial conditions tightened significantly, so we had to tighten less

- Anyone's ability to forecast beyond a few months is poor

- The dots aren't a promise, or an intention. They're conditional on forecasts and financial conditions

- Politics has no bearing on Fed policy 'we just don't think about it'

- You can be at full employment and not get inflation

- There is no concerted effort to communicate Fed hike, this speech was scheduled months ago

- Wants to see incoming data before June FOMC

- At Fed there is a growing focus on financial stability risks

- Core inflation is probably held down 30-40 bps by strong dollar and a bit by oil as well

- Excluding those factors, core inflation close to 1.8-1.9%

- Breakevens could be skewed by liquidity

- If conditions don't develop as anticipated, the FOMC could move faster or slower

- Brexit likely wouldn't be a systemic event, but would hit UK/European growth

- I can see Brexit as a reason for caution in raising rates

- Two rate increases was always there in the SEP

- I'm inclined to listen to what the market is trying to say on the path of interest rates

Former BOE MPC member Adam Posen is moderating the audience Q&A and asking a few questions of his own.

I'll update the headlines in real-time.