Fed's Kashkari takes a stab at Kevin Warsh

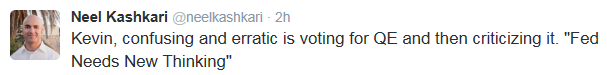

Minneapolis Fed President Neel Kashkari didn't like criticism from an op-ed in the WSJ yesterday from former Fed Governor Kevin Warsh.

"The conduct of monetary policy in recent years has been deeply flawed," Warsh starts out.

He goes on to attack the idea of raising the inflation target, something that thought leaders have been bandying about.

"It would please the denizens of Wall Street who pine for still-looser Fed policy," Warsh writes.

He neglects to mention that he was the Fed's primary liaison with Wall Street and supported QE1 and QE2 before leaving the Fed in 2011.

Kashkari hasn't forgotten.

To be fair, Warsh raises some great points about the academic groupthink at the Fed and a leadership that seems to be more concerned with holding and growing its power than getting it right.

At times, it's scathing:

"The economics guild pushed ill-considered new dogmas into the mainstream of monetary policy. The Fed's mantra of data-dependence causes erratic policy lurches in response to noisy data. Its medium-term policy objectives are at odds with its compulsion to keep asset prices elevated. Its inflation objectives are far more precise than the residual measurement error. Its output-gap economic models are troublingly unreliable," Warsh writes.

What's been impressive to me is the speed and tenacity of attacks on the Fed. If a recent insider is willing to use the Fed as a punching bag, then big changes may be near.