Highlights of the FOMC interest rate decision June 15, 2016

- Rates left unchanged in 0.25% to 0.50% range

- Labor market slowed since April meeting despite economic pickup

- Expects labor market indicators 'will strengthen'

- Repeats that economy to warrant only gradual hikes

- Drag from exports diminished, business investment 'soft'

- Spending strengthened, housing continued to improve

- Market based inflation compensation measures 'declined'

- Inflation to rise to 2% as oil and import price disinflation fades

- Pace of labor market improvement has slowed

- Will closely monitor inflation and global financial conditions

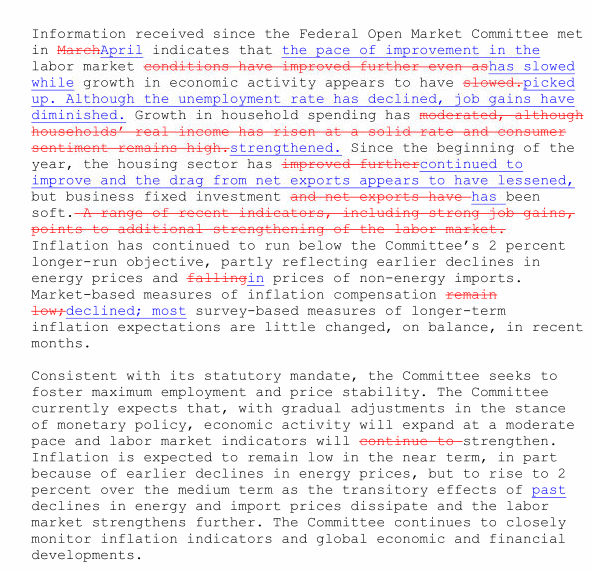

Here is the redline of the FOMC statement.

The rest of the statement is unchanged except that the vote was unanimous as Esther George dropped her dissent (she had wanted a hike in April)

The US dollar dropped on the headlines.