From BAML:

The Federal Reserve took the first step at normalizing policy, hiking the Fed Funds rate to a range of 25-50bp. The Fed underscored a gradual pace of hikes but the median dot for 2016 was unrevised, maintaining 4 hikes for the year.

The focus now turns to the Fed's next move. There are still some market participants in the "one and done" or "two and through" camps.

The Fed is trying hard to communicate otherwise, stressing that they are engaging in a hiking cycle, albeit historically slow. The Fed will be data dependent, hiking more quickly if inflation accelerates and vice versa if the economy weakens. But forecasting the Fed is not just about following the data, it is necessary to understand the Fed's reaction function.

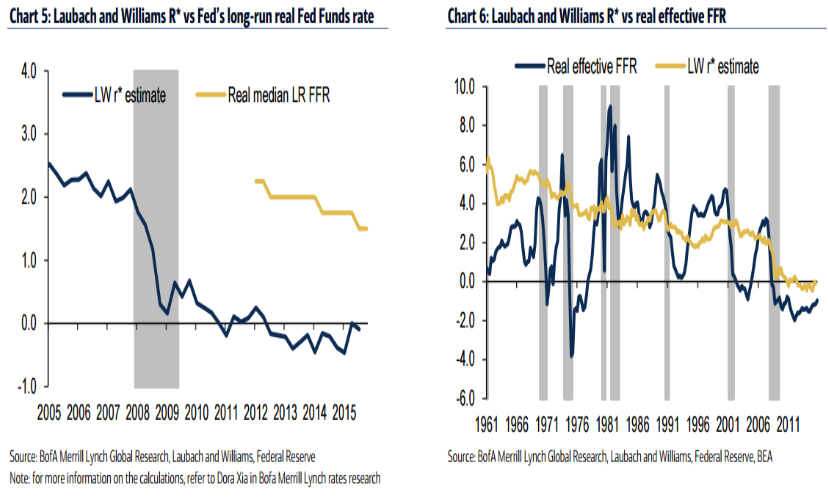

A key communication tool is the concept of an equilibrium real Fed funds rate, otherwise known as R*.

While short-run R* is close to zero, the long-run is still believed to be about 1.5% in real terms, suggesting a shallow and slow hiking cycle.

For trade ideas, check out eFX Plus.