Weak retail sales are the final nail in the coffin

The important line in the US retail sales report is the 'control group'. It's the measures that strips out potential autos, gas and building supplies.

It fell 0.1% in August compared to a +0.4% reading expected. In addition, the July reading was revised down to -0.1% from 0.0%.

A slowdown in automotive sales was expected after poor numbers from dealers at the start of the month but the pain appeared to be more broadly based and that raises some concerns about the economy. Consumers have been a rock solid source of strength for US growth so far this year and Federal Reserve members have frequently forecast a continuation.

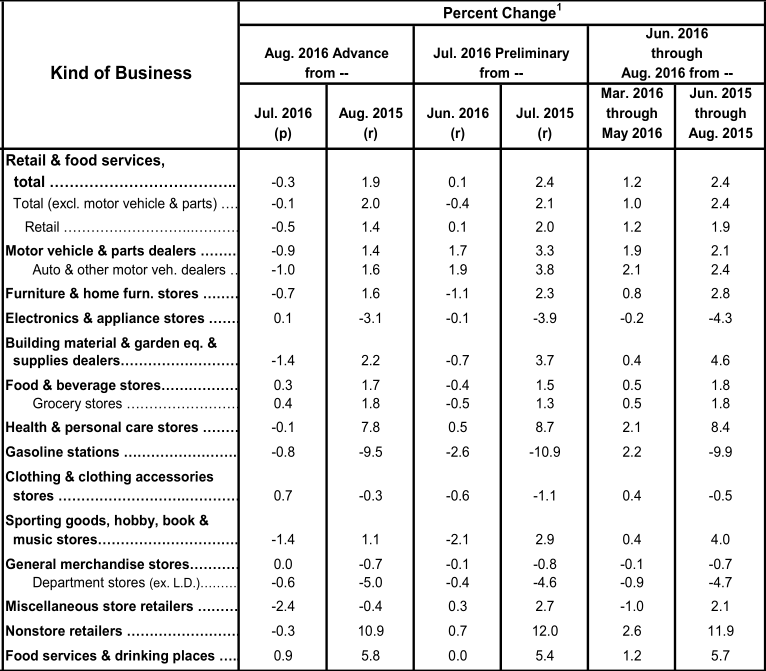

Drilling into the categories:

- Sporting goods, hobbies, books and music stores -1.4% m/m

- Furniture and home furnishings -0.7%

- Electronics and appliances +0.1%

- Food and beverages +0.3%

- Clothing +0.7%

- General merchandise stores 0.0%

- Non-store retailers -0.3%

Hopes for a Fed hike in September were on thin ice before the report at 22% in Fed funds futures are now down to 18%.

The real debate now is shifting to December with the odds at 50.1%.

FX reaction

What's more notable than the Fed or the data itself is the dollar reaction. Several times in the past week, there has been news or related market-moves that should have sunk the dollar. Yet each time it storms back.

When something doesn't sell off on bad news, it's an strong signal and that's what the US dollar is saying now.

On the retail sales report, the dollar slumped to 101.84 against the yen from 102.43 but within 30 minutes, it has completely recuperated the dip then continued to 102.77 -- a session high.