Markets in a 'show me' state

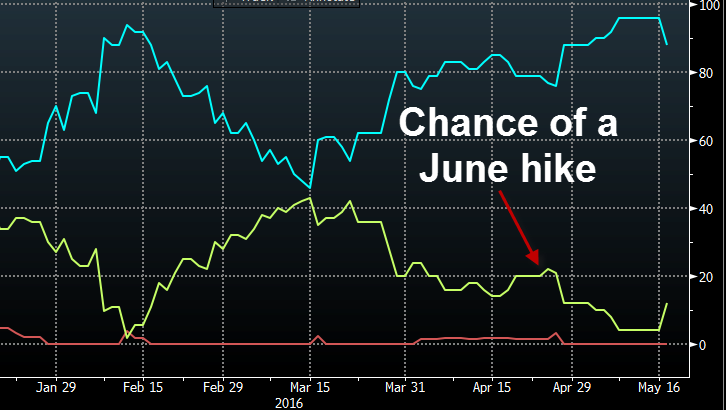

FOMC members Lockhart and Williams tried to send a message that a hike at the June meeting is possible on Tuesday.

"If the data continue to be encouraging I would certainly entertain some policy move in June," Lockhart told the FT today. "I don't think June should be taken off the table. I am of the view - others, my colleagues have said this - that markets may be reading this more pessimistically than I am. The [market-implied] probability of a rate increase in June is quite low."

Williams made similar comments.

There was a time when markets would get rattled the hawkish chatter but the Fed-believers have been burned too many times.

The implied probability of a hike in the Fed funds futures market is 12%; that's up from 4% yesterday but the likelihood of a single hike this year is just 62.8%, far from the 2-3 hikes Williams and Lockhart have touted.

Looking ahead, the Fed will need to do something to reclaim credibility in its forecasts and guidance. The best way to do that would be a hike in June but the flipside would be that they would lose communication credibility.

FOMC Minutes preview

One way to set the stage for a June hike would be with a series of hawkish hints in the FOMC Minutes to be released Wednesday at 2 pm ET (1800 GMT).

The Minutes are for the April 26-27 meeting but the problem is that the statement from that meeting didn't have any hawkish real hints.

A quick recap:

- Economic activity appears to have slowed

- Growth in household spending has moderated

- Labor market conditions have improved further

- Business fixed investment and net exports have been soft

- A line about global risks was removed

- Repeated that policy stance remains accommodative, despite speculation that would be removed

After the release, markets were left with a clear impression that a June hike is highly unlikely.

The line that 'economic growth appears to have slowed' is an especially tough one to spin into something hawkish. They could highlight arguments (like Williams has) that the data was skewed seasonally in Q1 but that still forces them to wait until after Q2 data is released.

What's the trade?

I can see some dollar buying on speculation it will be hawkish ahead of the release but I don't think it will happen. The loudest voices in the Fed-talk scene are the hawks or near-hawks like Lacker, Williams, Lockhart, George and Mester but they're outvoted and overshadowed by the Fed governors and FOMC members how are far less inclined to hike until they feel behind the curve.

For the FOMC Minutes, I think the trade is to sell the dollar ahead of the headlines.

For more on the problems at the Fed, check out this epic Fed rant from Greg Michalowski.