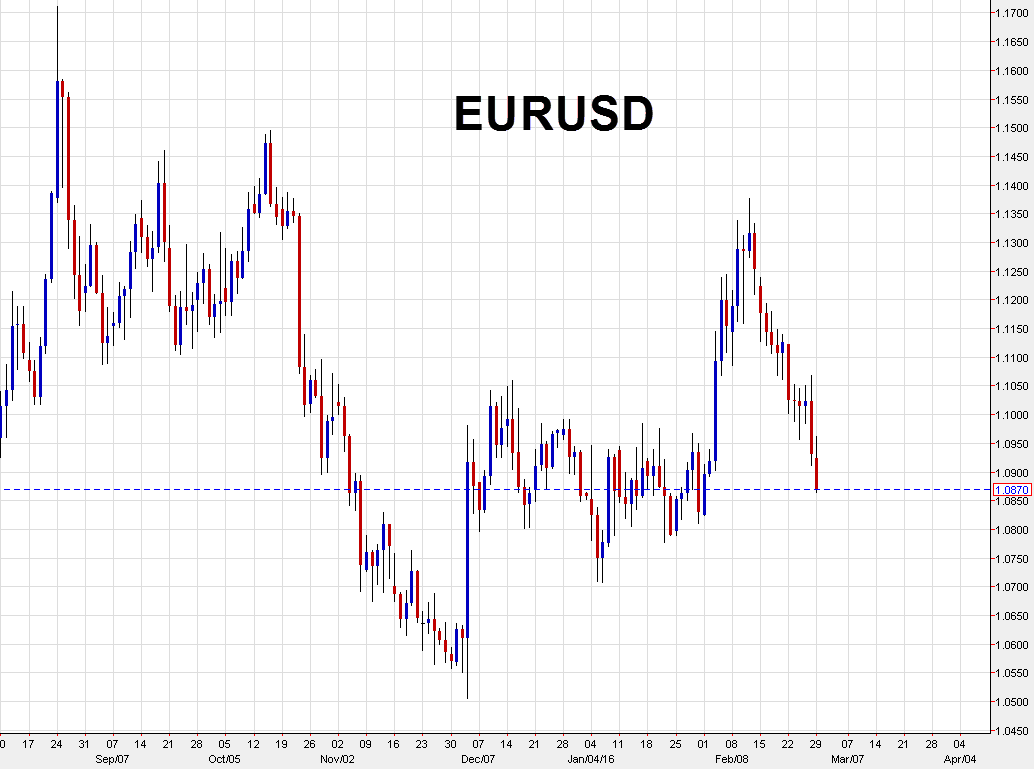

Huge gain finally erased

The early part of February included a major squeeze on euro shorts but with today's decline the pair is now in negative territory for the month.

EUR/USD is plumbing session lows, down 68 pips to 1.0866. The squeeze up to 1.1372 cleared out a large part of the crowded short trade. The weekly CFTC data now shows a net short at 47K and that's down from 48K compared to a week earlier. Look for that to race back towards the -100K area as we near the ECB decision and deflationary data continues to weigh.

Speaking of the euro, one of my top trades for 2016 was filled in February: Sell EUR/USD at 1.1150 with a target at parity. Stop at 1.1500. It's about 300 pips in the money now but still has a long ways to go.

My other trade was a CAD/JPY short that was closed out for an 800 pip profit. We sent the trades out to our educational newsletter. Sign up below.