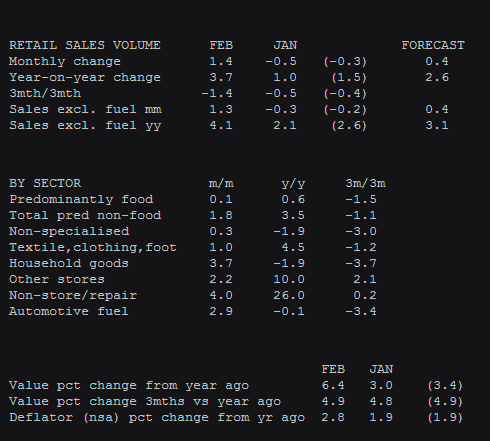

Details from the February 2017 UK retail sales data report 23 March 2017

Prior -0.3%. Revised to -0.5%

- 3.7% vs 2.6% exp y/y. Prior 1.5%. Revised to 1.0%

- Ex-fuel 1.3% vs 0.5% exp m/m. Prior -0.2%. Revised to -0.3%

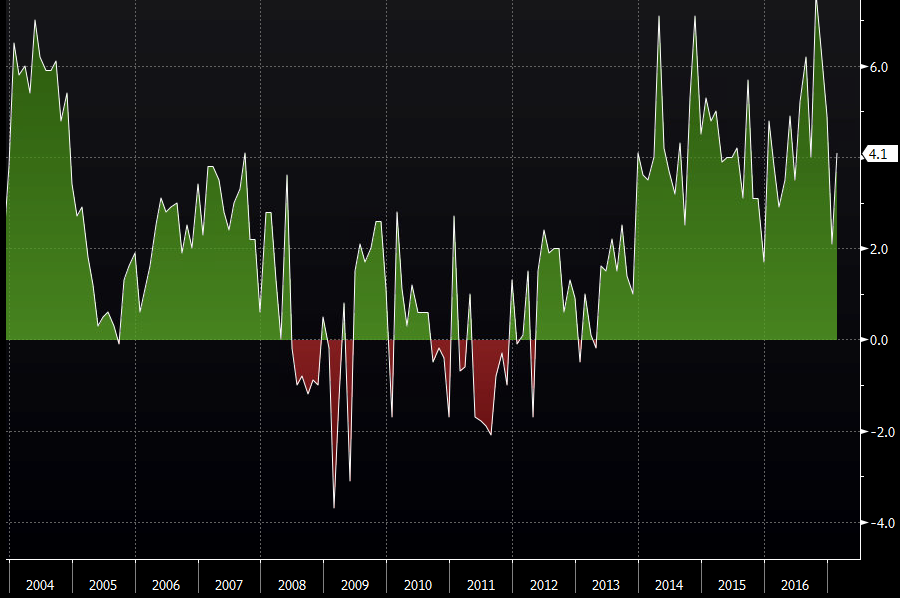

- 4.1% vs 3.1% exp y/y. Prior 2.6%. Revised to 2.1%

Strong numbers across the board. We can even overlook the lower revisions to last month.

Last month's number looked to be a problem but it's a notoriously volatile month. The worry then was the 3m/3m number dropping for the first time since Dec 2013. That hasn't improved this month and it's down -1.4% vs -0.4% prior. Rising food and fuel prices is what the ONS tipped as the reasons last month and they say fuel prices are having a particularly negative effect this month.

The price deflator has jumped to 2.8% from 1.8% in Jan y/y.

It's a decent report on the face of it, especially vs Jan, and it's caught a few people on the hop as all we've heard recently is that folks are expecting a consumer slowdown. Do remember that retail sales can be very volatile. The pound is enjoying the good numbers so who's to argue with that? GBPUSD ran to a 1.2527 high from 1.2470.

UK retail sales ex-fuel y/y