Price down sharply.

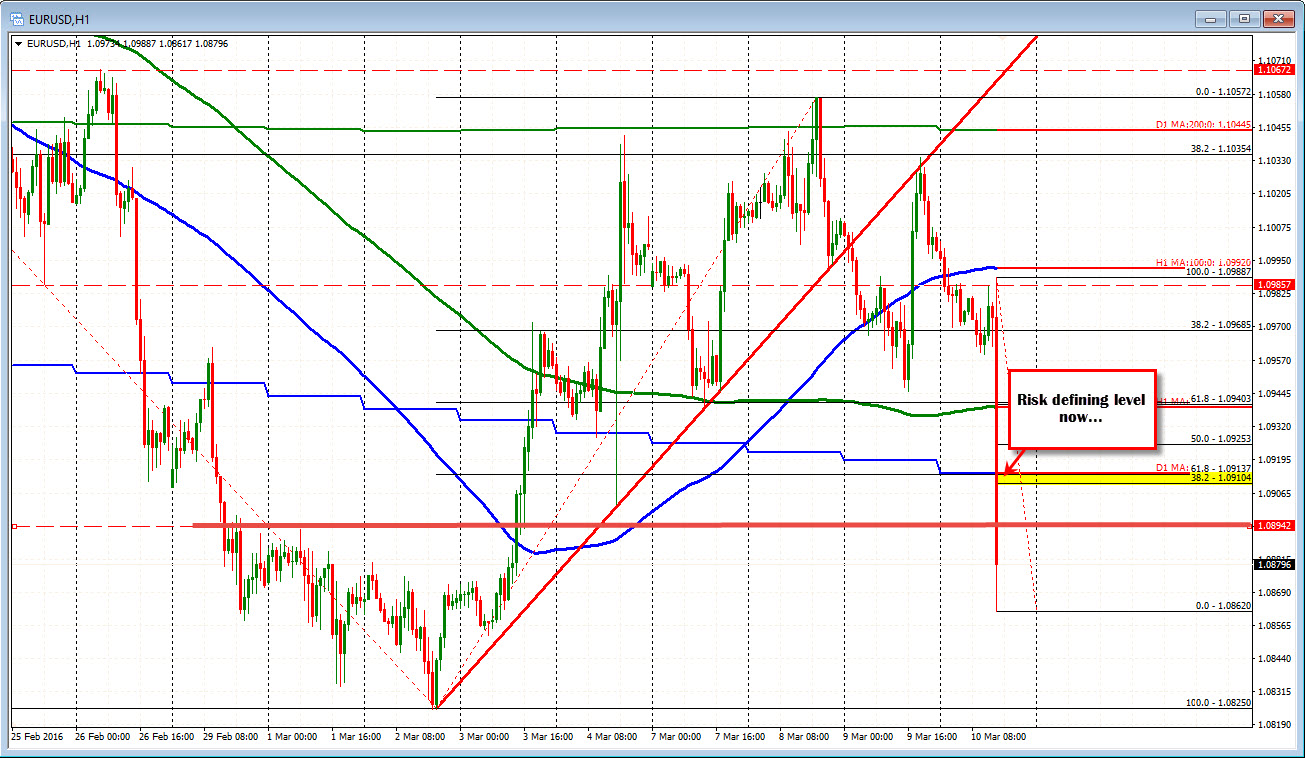

The EURUSD has fallen sharply after the ECB did a bit of everything. The price has moved below the 100 day MA at the 1.10915 level. This is now risk for traders. That should be a line in the sand. The pair has moved into the up and down range seen at the most recent bottom. The March 2nd low is the next key target area.

After quick moves, if the market pauses the weak shorts have the potential to lead to a short covering. In the event of a short covering, the 1.0894 is near the top of this lower range and should attract interest. Above that is the 100 day MA and the 38.2% of the move down from the range on the decision. That should be a pretty good (strong) upside barrier if the sellers are to remain in control. So far we have NOT seen much of a rebound at all as the shorts at the lows are not in a panic (the high I have seen is around to 1.0890).