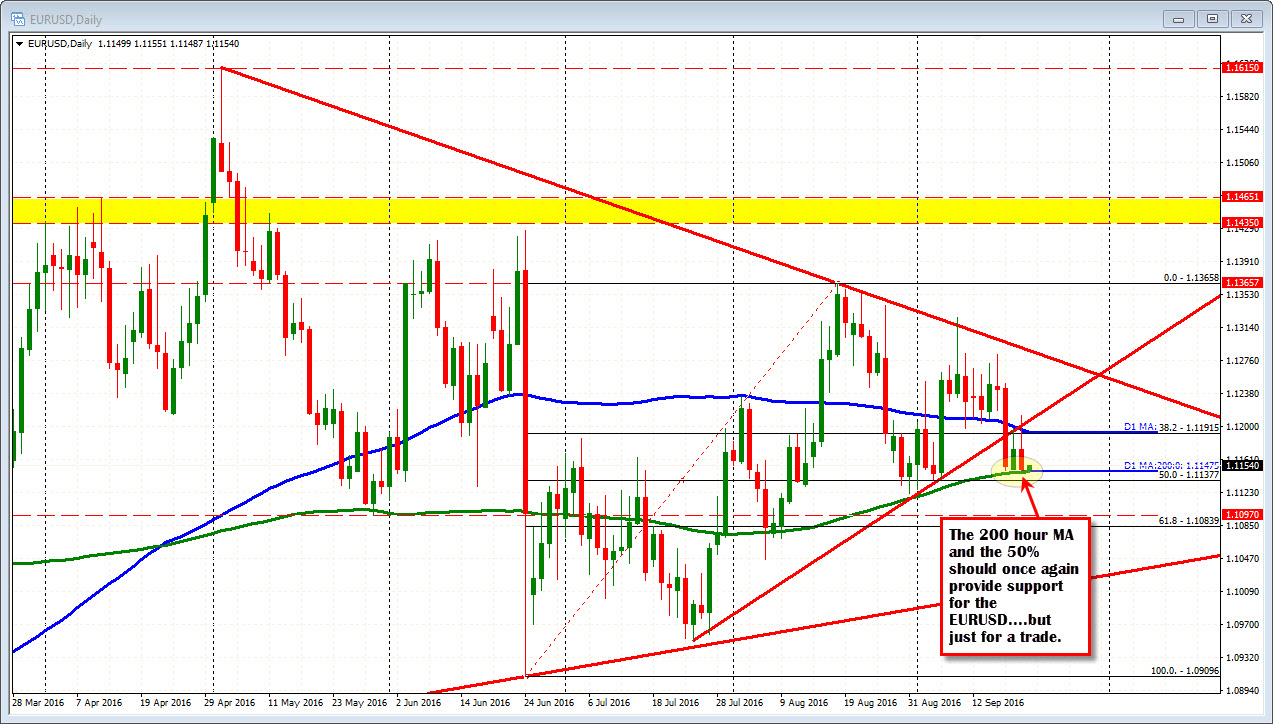

50% retracement level also in play

The testing of the 200 day MA is not something new over the last few days. On Friday, the price fell sharply and stalled against the MA level.

On Monday, the MA held again and the price rallied up toward the underside of the broken trend line and 100 day MA (blue line).

IN trading on Tuesday, the price moved above the 100 day MA and the underside of the trend line. That should have sent the price higher technically. It did not. Buyers turned to sellers and the price moved back down to the 200 day MA.

Now in the new trading day, the traders have a decision to make. Break below the 200 day MA at 1.1147 and the nearby 50% retracement of the move up from the June low to the August high - that level comes in at 1.11377 - and the bias should be more bearish. Stay above and we should see a wander higher..

SO the EURUSD sits on the fence.

Needless to say it is a decision time for trraders.

Unfortunately, that decision corresponds with the FOMC decision which should give the dollar a push. The BOJ may cause some movement. If those events/decisions were not in the way, I would be more confident about running a position if not stopped out. With the central bank decisions perhaps the best course of action is to think more in terms of scalping a few pips.

My gut says buy against the 1.11377-47 area with a stop below the 37 level. However, the level has to be right. I would be more inclined to wait for something in the mid 40s and look for the buyers to take the price back higher. If it goes below the 1.1137 get out. If it goes to the 1.1160/70s I would be happy to get out - especially before the BOJ decision window. That is just me. Trade it. Don't risk much. If right, take profit. Don't be greedy. If wrong, get out.