EUR/USD technical analysis chart views (some Elliot Wave in there) from Nomura, Barclays Capital, and Societe Generale, this via eFX.

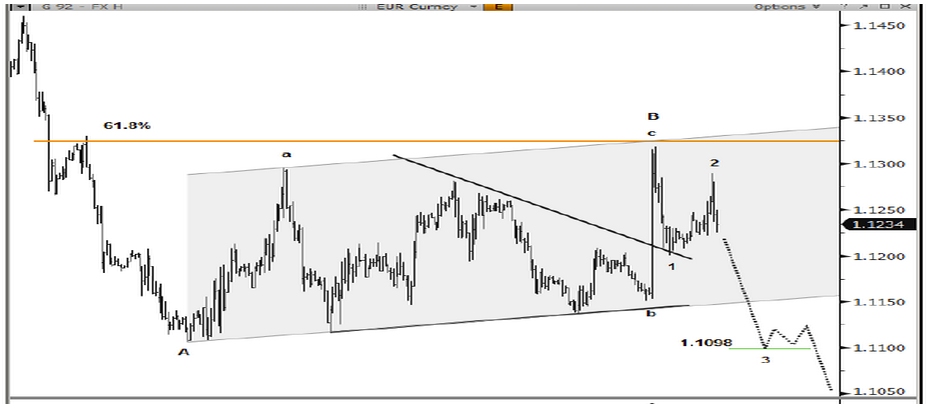

Nomura: a-b-c correction complete. Extension target is 1.1098

"The rally from 1.1105 (9/22) looks like a complete a-b-c correction. The move lower from Friday is the early stages of a new decline. Expecting a break of 1.12 to be followed by a break of the channel too. Extension target is 1.1098. From an Elliott perspective, the decline from 1.1289 fits as wave-3 so a sharp move lower would be ideal," Nomura projects.

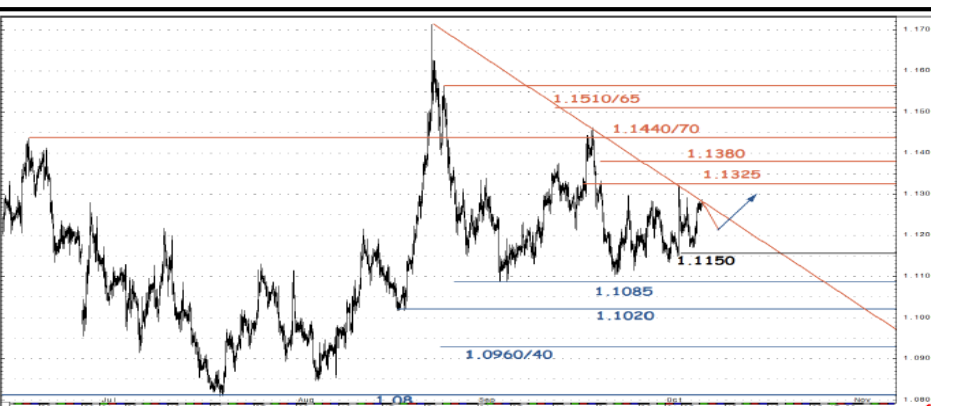

Barclays: We are bearish and would fade upticks in range against resistance in the 1.1320 area.

"Our initial downside targets are towards 1.1105 and then 1.1085. Below 1.1085 would confirm downside traction towards the 1.1000/20 area and further out towards 1.0810," Barclays clarifies.

SocGen: Corrective rebound in EUR/USD is evolving within a flag.

"A test of 1.1565 is not ruled out. However, a move above will be needed to signal a test of weekly upward channel at 1.1875. 1.1085 is likely to hold short term retracement while flag limit at 1.0940 will decide if a revisit of 1.05/1.04 happens with 1.08 as intermittent target," SocGen argues.