Goldman Sachs technical analyst says 'EUR/USD seems to be resuming its trend':

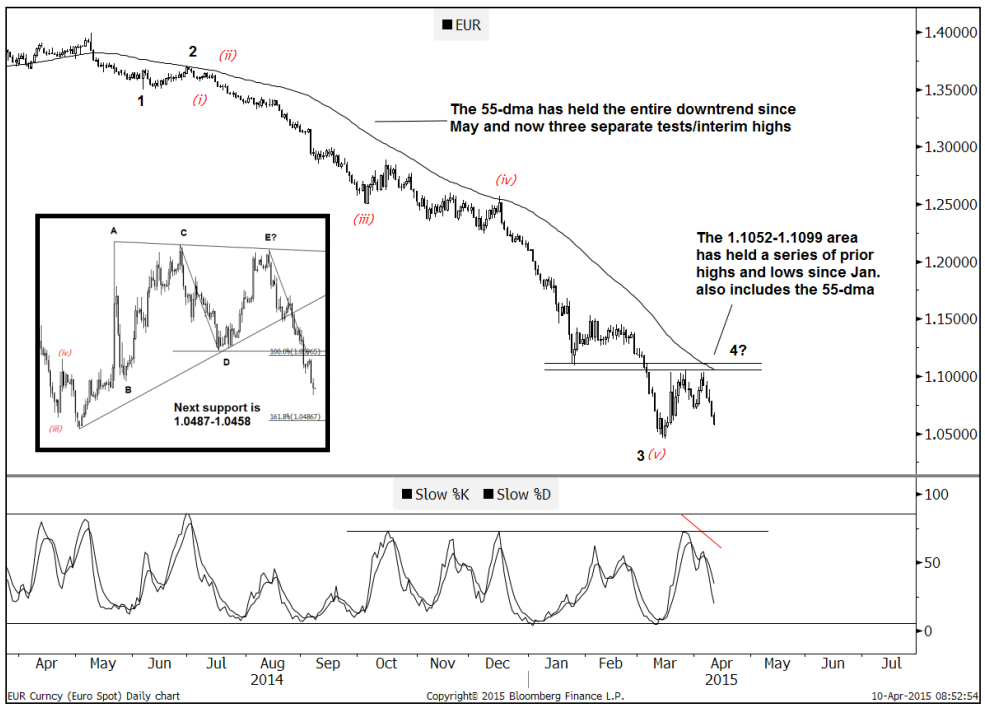

- It peaked on Monday, right underneath an important resistance area at 1.1052-1.1099. This region included the interim high (bearish key day reversal) from Mar. 26th, the interim low from Jan. 26th and the 55-dma.

- It's since broken lower from a triangle type pattern (ABCDE). Triangles tend to be characteristic of wave 4s which in this case suits the underlying wave count and implies that there is further downside potential.

- The next near-term support stands down at 1.0487- 1.0458 (1.618 extension from Mar. 26th and the low from Mar. 15th).

They go on to say that:

- The LT target for EURUSD is back in focus; 1.0286-1.0103... Ultimately still like this level as a near- to medium- term target

- This 1.0286-1.0103 pivot includes 76.4% retrace of theentire '00/'08 rise as well as an equality target taken from the Jul. '08 peak. Reaching it would satisfy a multi-year ABC which began in '08. It would consequently be an ideal place to take on a more neutral outlook.

--

I'm not a user of Elliot Wave, but perhaps some of those ForexLive traders who are would like to weigh on GS' interpretation?