The euro is largely unruffled by yesterdays USD bounce

We've got one of those in between ECB meetings today. There's no policy action expected so it will just be an exercise in questioning Draghi about recent events.

We can expect the usual questions on QE and how long it will last. That will be tied in to the jump in inflation and whether that would see the ECB cutting QE before the end date. Draghi will repeat that they want to see a sustained uptrend in inflation, not just potentially one off moves, and will highlight the core number holding steady as a reason why they're not getting excited about inflation.

The Bundesbank buying bonds below the deposit rate will get some scrutiny. The decision to remove the cap on yields that could be bought was a nod towards the issue of scarcity.

We can expect the usual stuff on downside risks, moderate recovery, headwinds etc etc and no doubt the press will throw some Trump and Brexit questions into the mix.

December's meeting was really a can kick until the spring when QE gets reduced, and we get the next updated staff projections, where we'll hear if the ECB sees anything changing on the landscape.

There's probably very little risk for the euro here today but that might not stop the robots from reading the same headlines and comments repeated from Dec and taking the euro on a little wander.

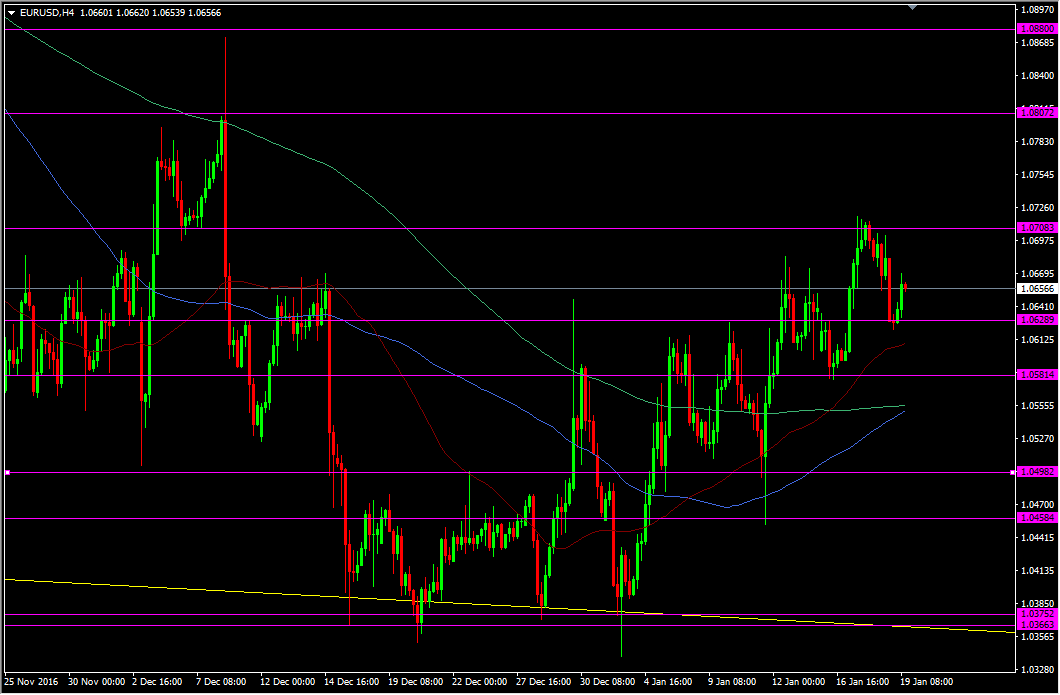

When the dollar perked up yesterday the euro suffered but it has since been supported by yen selling than continued USD strength. The uptrend in the euro is still intact so unless something comes out of left field from Draghi, there's no real reason for that trend to be really tested.

EURUSD H4 chart

Should we see a dip in the euro, the area around 1.0580 down to the merging of the 200 and 100 H4 ma's is looking ripe for a dip buy. If we head up, we would still need to see the 1.0700/20 level taken out properly before thinking about anything more.