Pair is looking for push

The EURUSD has positioned itself in between support and resistance as the key US employment statistics for September are awaited.

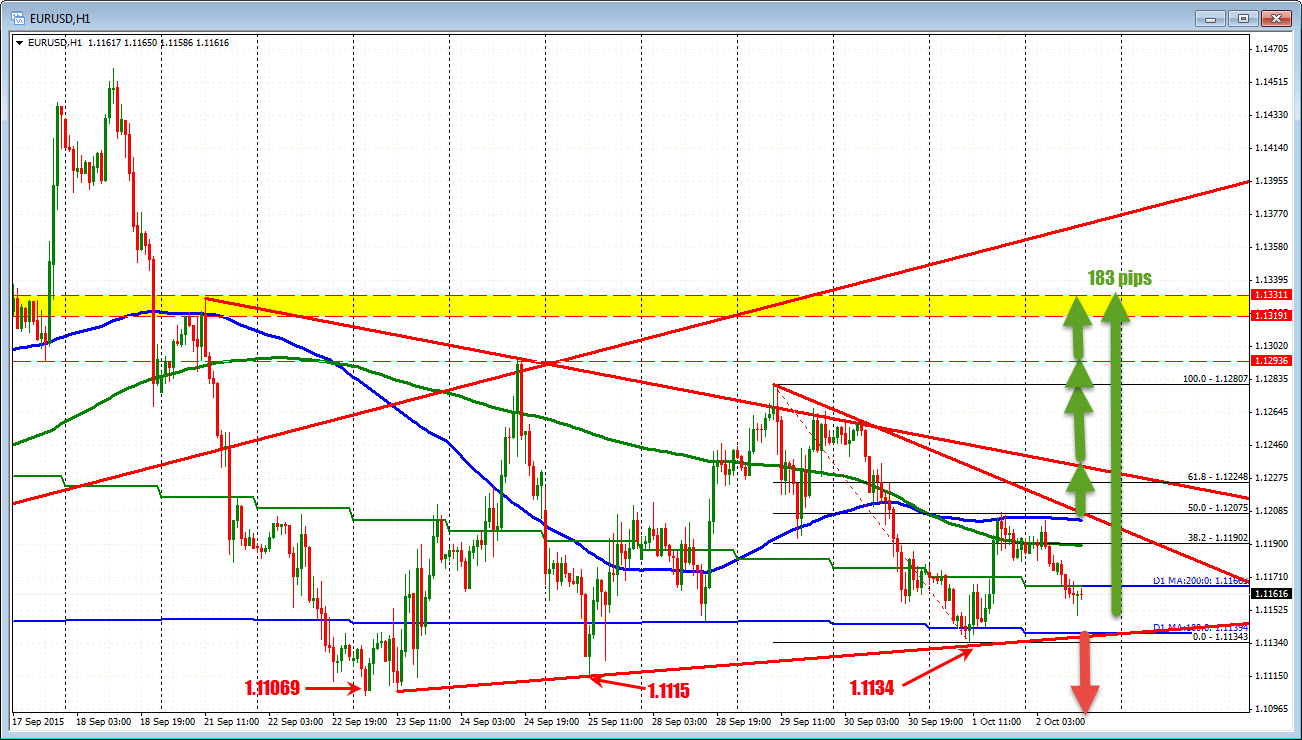

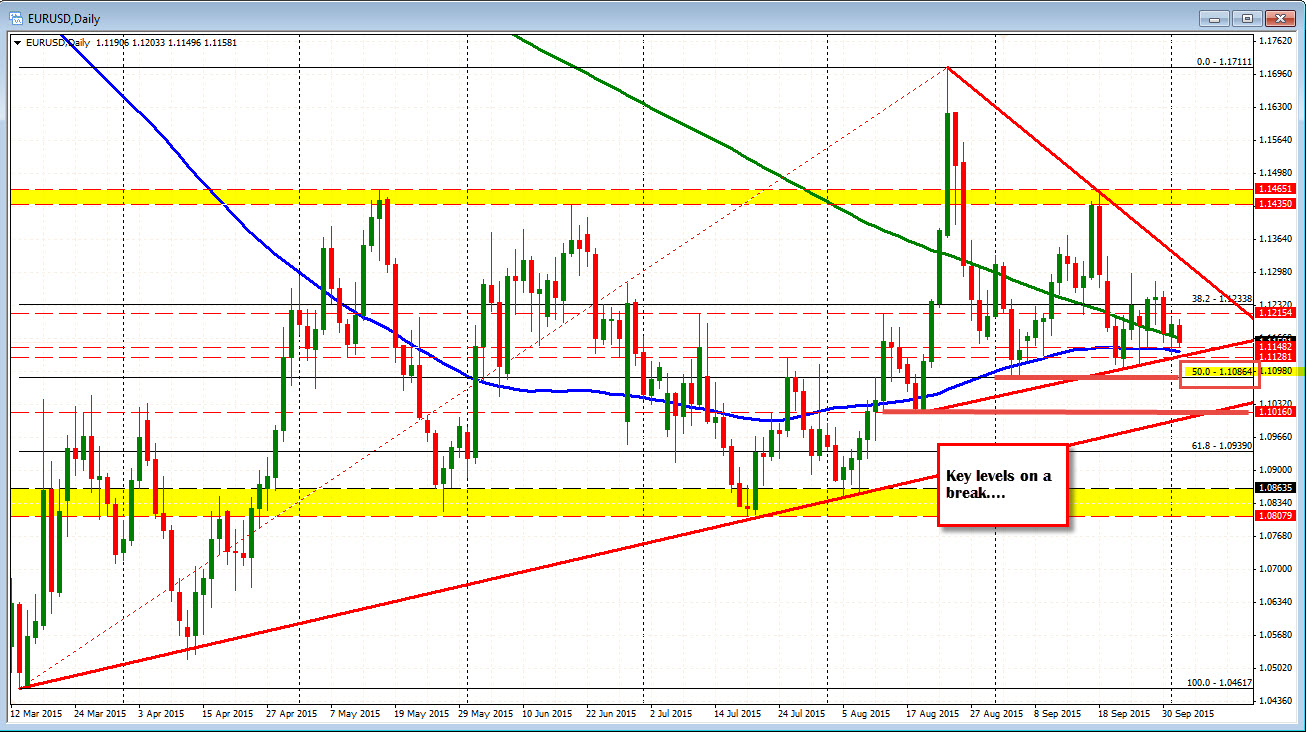

Looking at the chart above, the last 48 hours or so has positioned the pair between the 100 day moving average (the blue step line in the chart above) on the downside in the 100 hour moving average (the blue smooth line in the chart above) on the upside. Those levels come in at 1.11394 for the 100 day moving average, and 1.1203 for the 100 hour MA (the high today stalled at this level) . Also near each of those extremes are trend lines increasing the areas importance on a break.

So for trading on a stronger than expected release (i.e. >220K and upward revisions, 5.1% or lower, average hourly earnings no less than 0.2%), look for the price to move below and stay below:

- The 100 day MA at 1.1139 (line in the sand).

- The pair should then look toward the lows from September 22 at the 1.11046 level.

- The 50% midpoint of the move up from the 2015 low comes in at 1.1086. WIth a high today of 1.1203, a move to that level would imply a range for the day of 117 pips. That should not be a problem to get to on a stronger number.

- Below that, and the pair does not have a whole lot of support until the 1.1016-23 area which were lows Aug 18/19 and 12th.

On the topside on a weaker number (<175K, revisions lower, Unemployment rate >5.1% and earnings <0.2%), the EURUSD will likely:

- Break straight to the 100 hour MA and other resistance at the 1.1203/07 area. In addition to the 100 hour moving average, a down side trendline and the 50% retracement of the trading range this week comes in near that level (at 1.12075 area).

- A move above that level will nest target 1.1234 area (trend line)

- The 1.12807 is the high for the week and will be the next target

- Finally the 1.1319-1.1331. Going back to September 1, there are a number of highs/lows that stalled in this area on the hourly chart. A move to this level would imply a range for the day of 183 pips. That is doable given a weaker number with Fed on hold implications.

Risk is elevated into the number. It . The market is expecting a better number/revisions. Keep an eye on the unemployment rate. The market will likely tolerate a lower NFP with a lower unemployment rate. As the economy gets closer to full employment, the job additions can slow but if the unemployment rate falls, wages should start to increase.