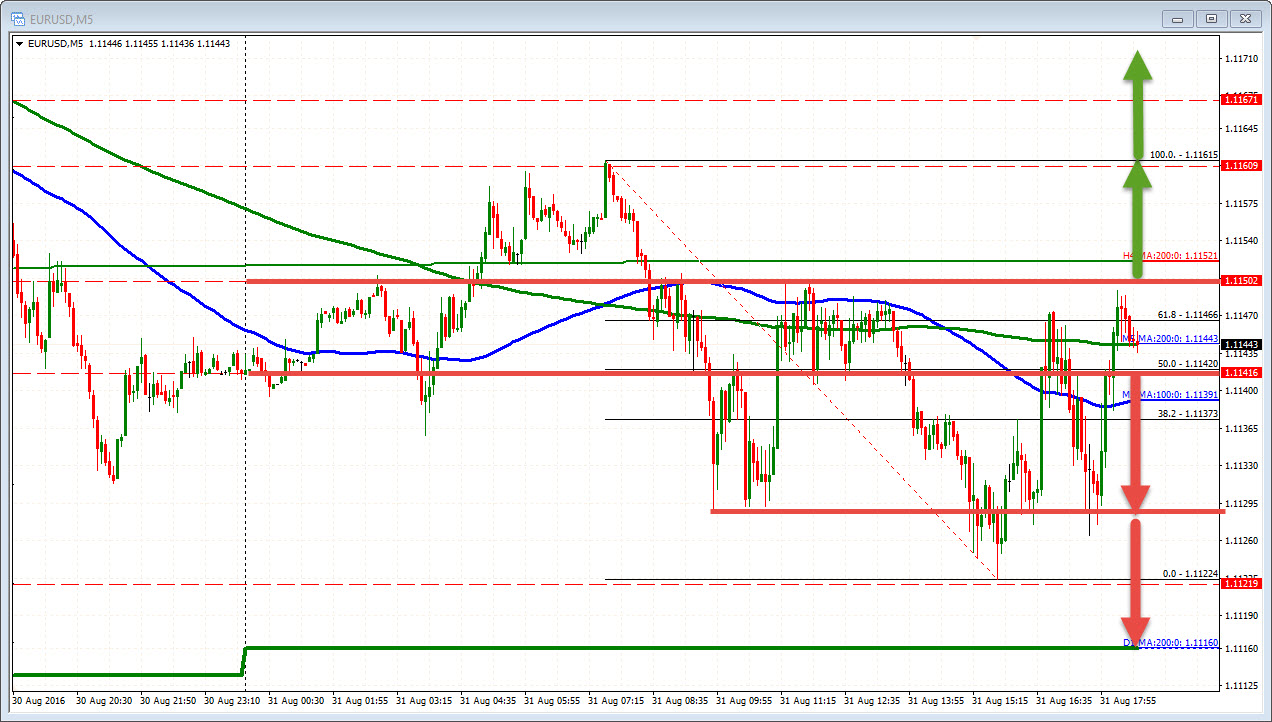

Fixing/London traders looking to exit with more upside momentum

The range if only 39 pips, but the EURUSD is trading at NY session highs and is back positive on the day (above 1.11416). The 4PM London fixing seems to have traders liking the long side.

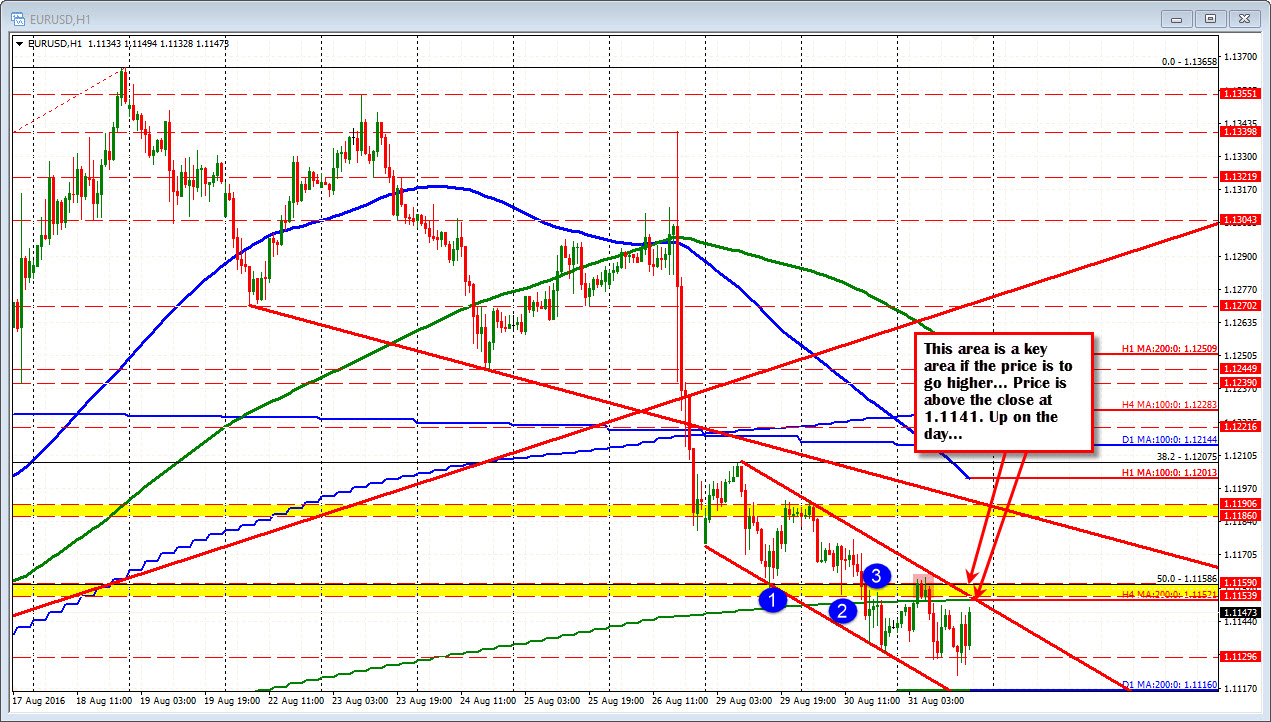

For the day, the pair has spend most of the day below the 200 bar MA on the 4-hour chart at the 1.1153 level BUT above the key 200 day MA at the 1.1116. The low reached 1.1122 today.

In addition to the 1.1153 level, there is other resistance up to 1.11586 which is the 50% of the move up from the July 25th low. The high today squeaked up to 1.1161 before falling.

The area between 1.1153-586 remains a key level to get to and through if we going higher.

Will traders take the late day London buying (move above the close) and trade more positively in the NY PM? Did the intraday sellers have their shot and now it the the buyers turn to try and extend the range? Or will the pair move back below the 1.1141 close and have that run to the 200 day MA once again?

I am not sure at all. When the price was below the 1.1141 level (before the push higher) I thought a run lower to the 200 day MA was in the cards at 1.1116.

Higher? Lower? Or lie down until the feeling goes away as it is not worth it? What do you think?