The chop is still on

The EURUSD has moved back lower as the equity markets move to close.

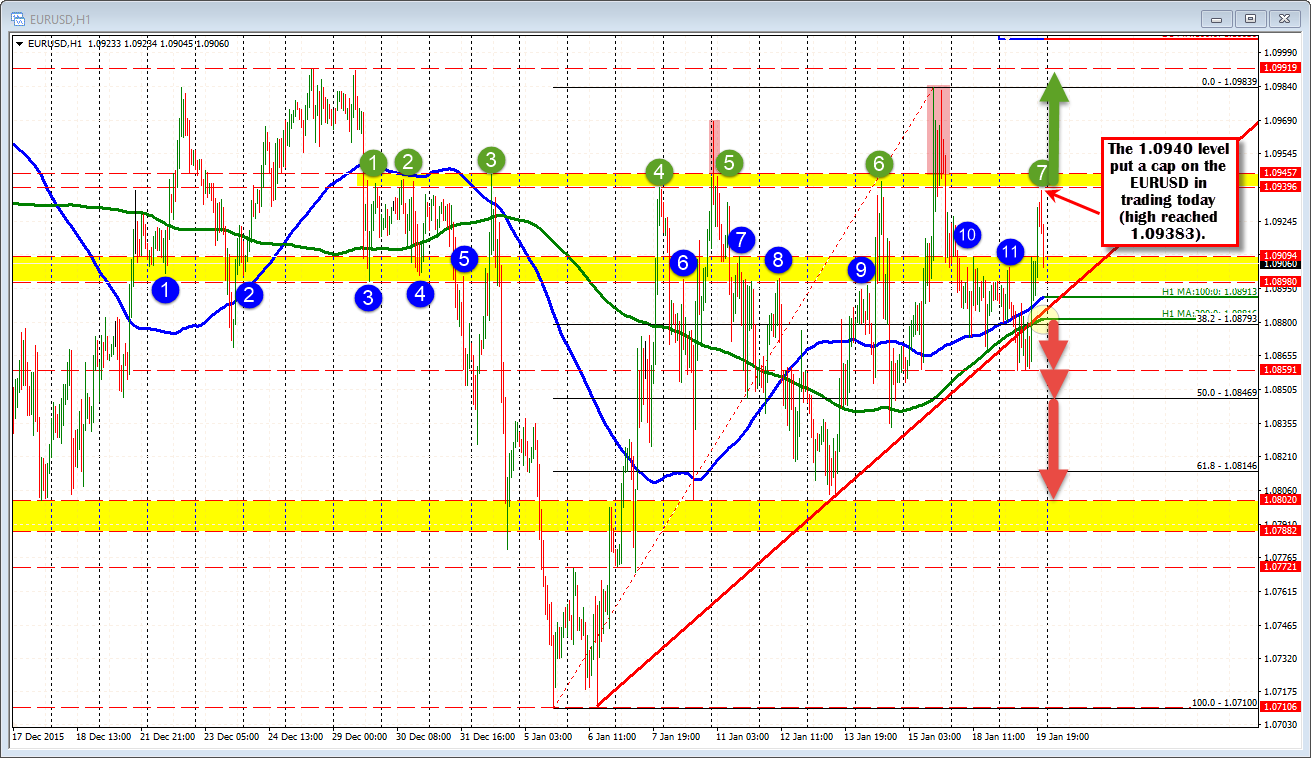

The pair moved up toward resistance near the 1.0940-457 area. There have been a number of swing highs near this area. The high price peaked at 1.09383.

The pair is back down testing the 1.0900 level where there are a number of swing highs and lows between 1.0898 and 1.0909.

There are a other levels I have earmarked as "levels to eye" in this pair including the:

- 200 hour MA and upward sloping trend line. They come in at 1.0881-83 currently.

- The 38.2% is around that level at 1.08793.

- The 1.0859 was a low on Friday and again today.

- On a lower extreme 1.0788 -1.0802.

On the topside, that 1.0940--457 area is key in the new trading day. A move above will have traders looking toward the high last wee at 1.0984 and the highs from December (peak at 1.0992)

The chart above looks to be overcrowded with stuff. That comes part and parcel with the up and down choppy markets. Usually, when this happens traders will define their limits, with a wary eye on a break out at some point. Today the low bottomed against a low from Friday and peaked against a resistance area. What will the new day bring for traders? I suspect traders will lean against one of the levels and see if the wind blows in their favor. If it does, they will look for the next target. If it does not, they will get out.