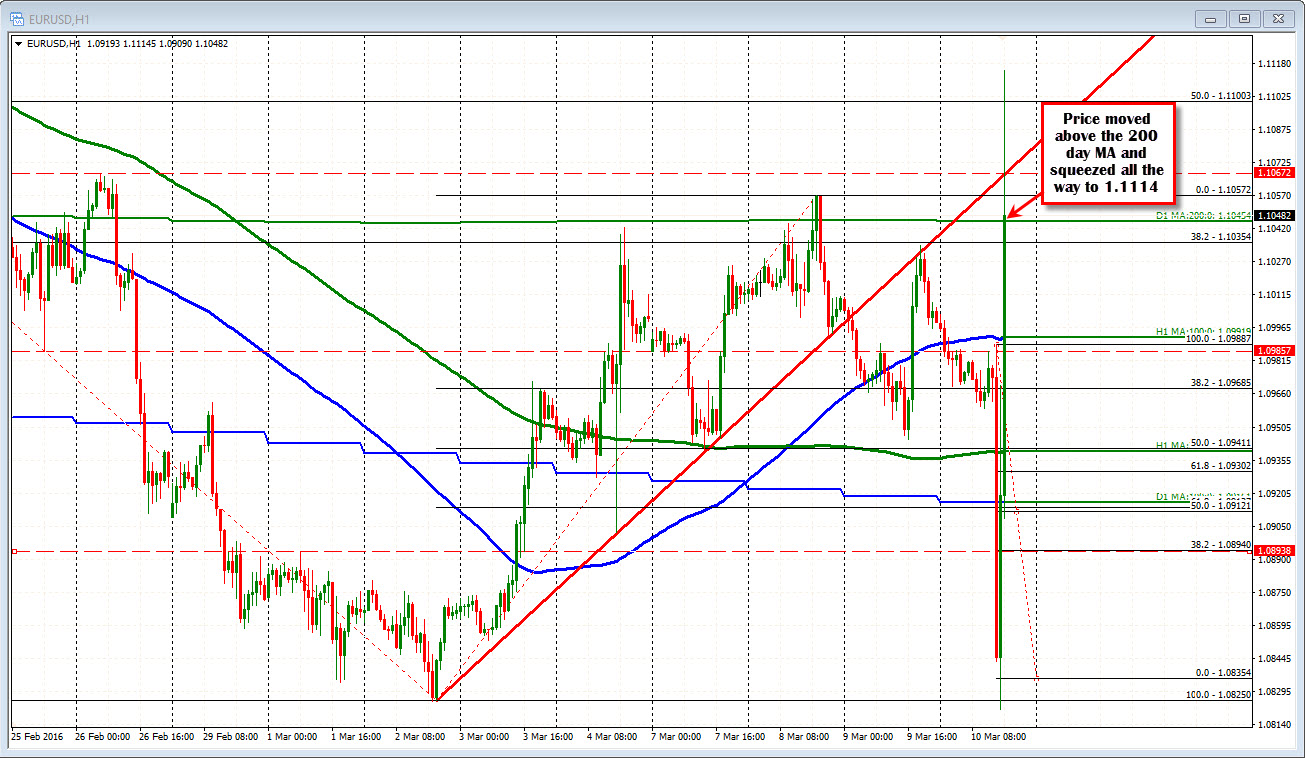

200 day MA at 1.1045

The squeeze has taken the price above the 200 day MA now at the 1.1045 level. It also broke above the trend line that stalled the rally yesterday.

Put the scenarios down on paper and this was not one of them.

Needless to say shorts were caught. The move above the 100 day MA was an initial catalyst. You can see it on the 1 minute chart where the MA was broken, tested and the off to the races. In a 6 minute stretch the price moved 172 pips in illiquid trading. Market Risk. Event Risk and Liquidity risk rears its ugly head.

Anything can happen when risk is sky high. The 100 hour MA is at 1.0991. Is it a support target now? The 38.2%-50% of the days range is 1.09677 to 1.1002. Is that support now?. The whole ECB thing started at 1.0974. If you don't have a position, understand all three risk measures are high. If it can go 172 pips in 6 minutes, anything can happen. There are better times.....