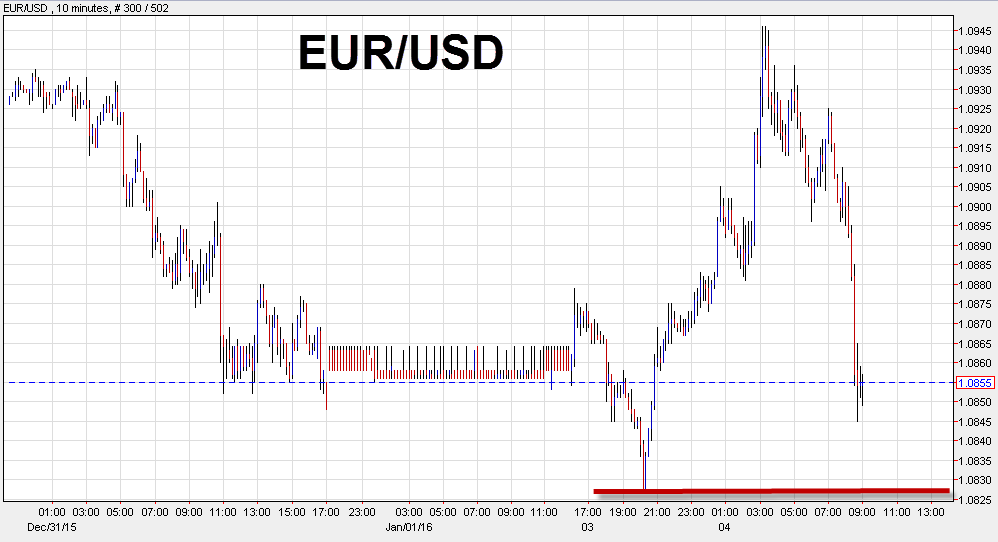

EUR/USD flat at 1.0850 after rising to 1.0945

The euro was up nearly a cent on the day in early European action but tit's back to flat after German inflation figures showed the ECB still has much work to do.

The early HICP was at +0.2% y/y compared to +0.4% expected. The ECB has blamed low oil prices for virtually flat prices on the year but a soft economy in Germany and elsewhere is equally to blame.

Draghi & Co won't be in any rush to ease further as they will want to see the impact of the December measures. That and the hawkish Fed puts a bull's-eye on March as a critical time for central banks.

That timeline could be moved up if the panicky mood in markets continues but it's way too early to draw conclusions.

The intraday level to watch is 1.0827, which was the low in Asia before the market reversed. After that, the post-ECB lows near 1.0800 are critical. If they break, it could be a quick trip back to 1.0500.