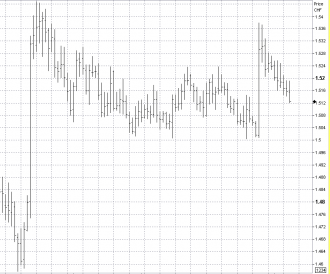

“It coulda been me.” Relieved EUR/CHF longs are thinking their lucky stars that their cross did not go into freefall like EUR/JPY and the other JPY crosses today as risk aversion made a return to the market. The market remains quite long the cross and they pray the SNB and their allies continue to support the cross in the days ahead.

We’ve fallen back to 1.5125 thus far and are holding well above 1.5000/05, the so-called “line in the sand” that the SNB seems to have drawn as part of its quantitative ease strategy.The question is, does it make sense to hold onto positions which show relatively few prospects for explosive gains and reasonable high prospects for testing one’s dwindling patience. I’d be a seller on strength toward 1.5190/95, where we’ve stalled several times in recent sessions.