EIA crude oil inventories for the week ended Aug 28:

- The 'consensus' was undoubtedly higher than +444K, probably closer to +4440K

- API reported a 7600K barrel increase in its latest report

- Gasoline inventories -271K vs -2000K expected

- Distillate inventories +115K vs +1000K exp

- Cushing inventories -388K vs +400K exp

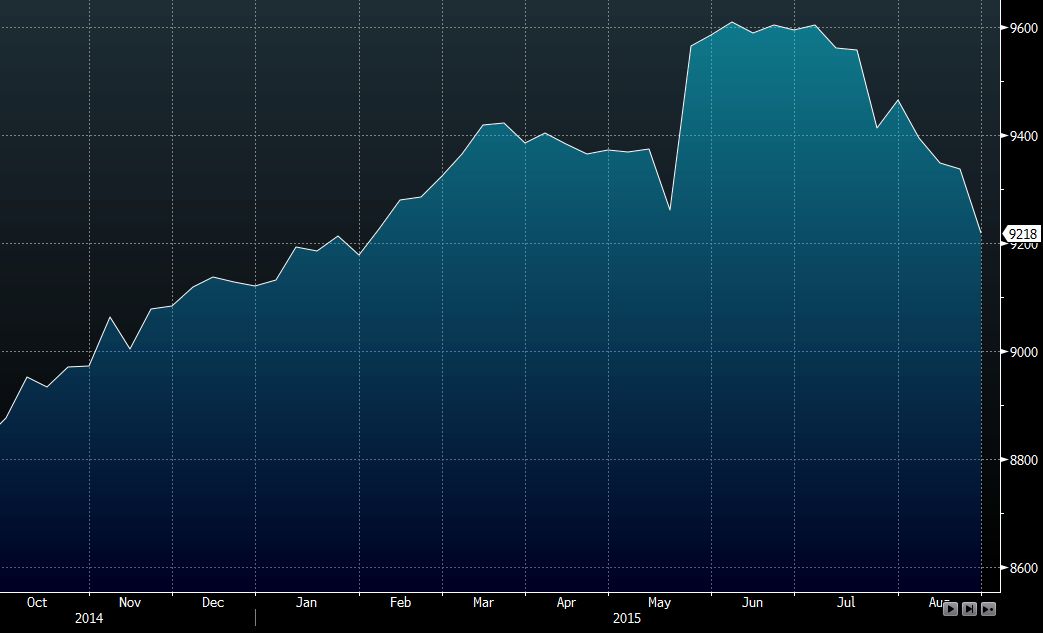

- Production -1.3% to 9.218 mbpd vs 9.337 mbpd

Oil quickly down to $44.27 from $45.08 ahead of the report. I'm not convinced this is terribly bearish news. The reading was more bullish than API signalled and right around where I expected. In addition, the production numbers (which aren't well publicized) are bullish.

I think crude will hold the lows but given how wildly emotional this market is; expecting it to react to purely fundamentals is a dangerous assumption.

US oil production is at the lowest since Feb