There is very, very little on the economic data calendar today (check it out in full here). What we do have is data from NZ and Australia. Adam did a preview here: Australian capex report up later, how to trade it

NZ data due at 2145GMT

October trade balance,

- expected is -1bn prior was -1.222bn

Exports,

- expected is 4.00bn, prior was 3.69bn

Imports,

- expected is 4.97bn, prior was 4.91bn

Australian data due at 0030GMT - Private Capital Expenditure survey for Q3

The 'headline' is expected to be -2.9% q/q (prior -4.0%), dragged down by the ongoing declines in mining investment (a well rehashed story in Australia over the past few years, of course ... annual growth in capex is at its lowest since Q1 of 1992). In addition to declines in mining infrastructure work, commercial building is likely to have declined, while equipment investment is in danger of falling also. Positive surprises might come from non-mining related investment

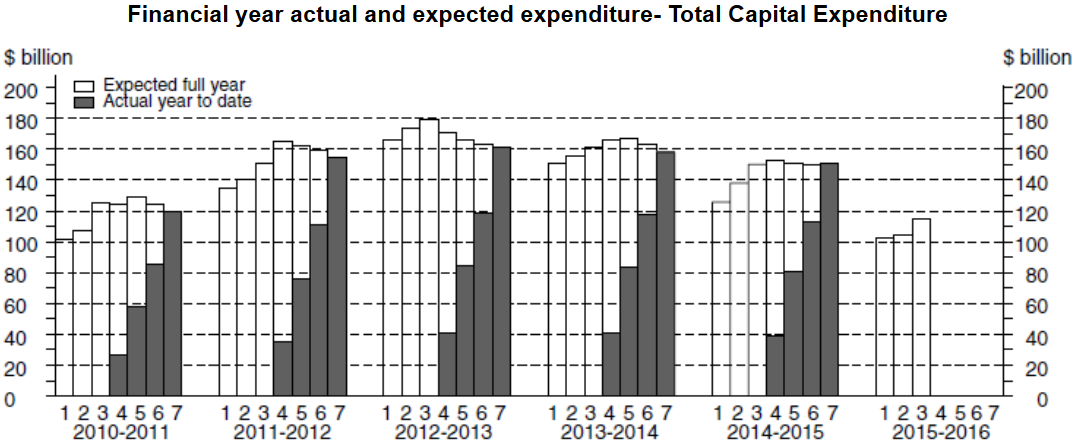

Apart from the headline, the focus will switch immediately to the fourth estimate 2015/16 investment. Estimate 3 was at A$115bn. A minor upgrading is expected

The previous years' estimates vs. actuals, and also a stark reminder of the 'capex cliff'.

-

For the AUD ... as I said yesterday, three are no changes from the RBA expected at the next meeting (December) and it a long wait until the following one (February). I suspect the immediate impact of the data today, unless its a shock, to be subdued.