ABN AMRO reaction to the ECB

ECB leaves monetary policy unchanged... The ECB disappointed keeping its monetary policy stance completely unchanged. The inaction with regard to policy rates and the pace of QE purchases was as expected. However, we had expected the Governing Council to expand the horizon of its QE programme. The ECB also did not announce changes to its QE programme to increase the universe of eligible assets at the press conference.

...but signals action in the coming months. However, ECB President Draghi left the door open for action in the coming months. He said that the Governing Council had tasked committees to evaluate various options for the smooth implementation of QE, reflecting the necessity to increase the eligible universe of assets. The President clarified that the committees had a full mandate to look at all options (including adjustments to the capital key), though the Governing Council will make the final decision.

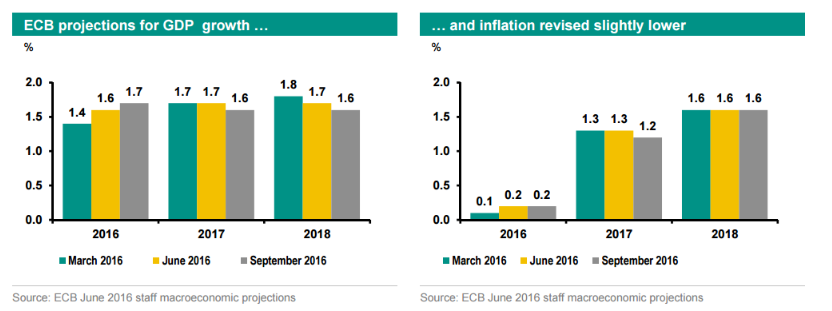

Second, although the ECB had not discussed an extension of the programme at this meeting, Mr Draghi asserted that it remained ready, willing and able to act. In addition, he said the ECB's decision that action was not necessary was a judgement for 'the time being'. Finally, the ECB continues to forecast that inflation will undershoot the goal (see below), and that it was a matter of concern that underlying inflationary pressures were not picking up. At the same time, the risks to the economic outlook remained tilted to the downside.

We think the ECB will expand the duration of its QE programme from March 2017 currently to September 2017 before the end of this year and most likely at the October meeting. The momentum behind the eurozone recovery has slowed and the overall pace of economic growth remains too moderate to generate significant underlying inflationary pressures any time soon.

Steps to increase universe of assets. As signalled, the ECB will also likely announce changes to its QE programme to increase the universe of eligible assets as it will not be able to meet even its current targets under the current structure. We think there are two possible options (either separately or in combination). The ECB could decide to start buying bonds that yield less than the deposit rate (so far restricted) as well as buying bonds below the 2y maturity. Second, it could increase the issue/issuer limit from the current 33%. We think that another often-mentioned option - the dropping of the capital key allocation system for purchases and moving to an outstanding debt allocation scheme - is not likely. Such a move is supported by only a minority of the Governing Council at this time and the ECB will likely opt for other options first.

For bank trade ideas, check out eFX Plus.