A preview of Mario Draghi, president of the European Central Bank, at the European Parliament on Monday.

I thought his speech would be something like "On being upstaged by Kuroda" ... but no, Draghi is presenting the ECB 2015 annual report.

Draghi will answer questions from the members of parliament

We can expect Draghi to discuss monetary policy alternatives going forward, and for him to get questions on inflation

On January 21 at his post-meeting press conference Draghi indicated that the ECB may review its policy alternatives in March

Currently:

- The asset purchase programme (quantitative easing (QE)) had the ECB buying public & private sector securities at the rate of €60 bn every month, through until September of this year, but has been extended to March of 2017 (or beyond if necessary)

- The ECB's benchmark main refinancing rate is at 0.05%, the deposit rate is negative, at -0.3% per cent (the deposit rate was trimmed in December by 10bp, in a move the markets judged decidedly underwhelming)

If the ECB reviews its alternatives in March, it'll be because there has been no improvement in moving closer to the inflation target. The most recent inflation indications from Europe show the annual inflation rate at around 0.2%, far short of the ECB's target of around 2%.

Oil prices, of course, are cited as a key downward pressure.

Scheduled at 1600GMT

-

Its a 'wait and see' for Draghi's testimony, but he is expected to maintain his overall dovish rhetoric. A key risk is any back pedaling on his dovishness, which seems highly unlikely but I thought I'd mention it. While I doubt very much we'll see any concrete proposals from him on potential moves in March, he may float what's on his mind. He faces a tough ask getting more easing through the ECB Council, but that's likely an issue for another day.

-

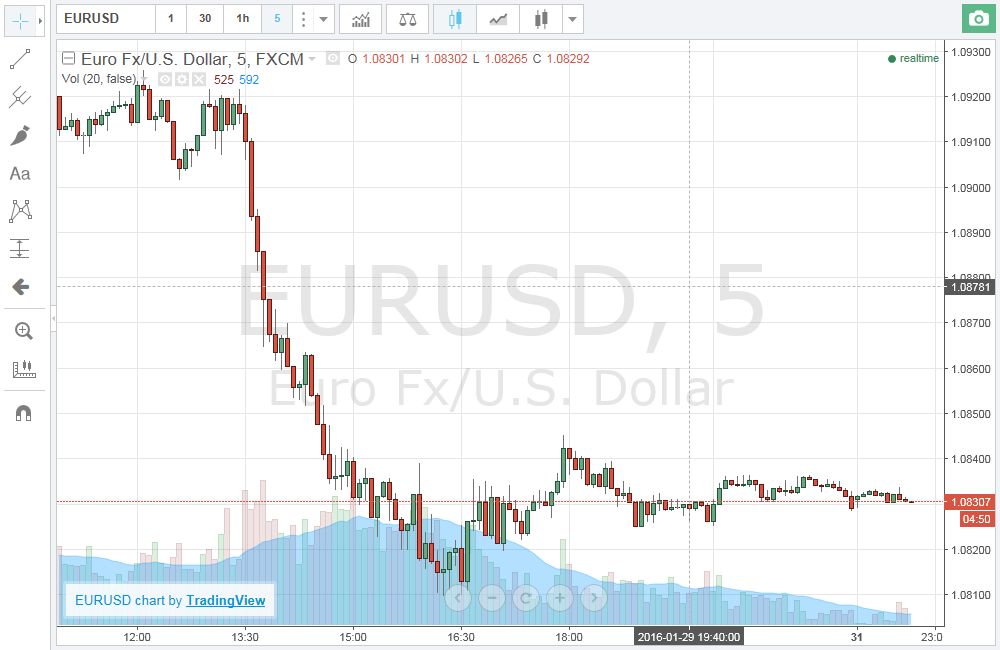

EUR/USD has opened the week quietly and is likely to stay that way until Europe time.