A mixed bag for Fed watchers

A decent read from durables, a softer core PCE and a lacklustre consumer gives the Fed a few differing views

Staring with durables

It was a fairly good report. What's wrong with it though? We know that we had a pick up in manufacturing in October, and that it looks like that's being washed out in November, going by manufacturing data so far this month. It still means that the start of Q4 was good but we'll have to see what happens in the Nov durables report. For the Fed that may not matter as we'll be through the Dec FOMC before we see that data. The revisions via the factory orders report comes on the 3rd Dec, so they'll be important, especially with Yellen speaking that day too

There hasn't been a definitive trend in durables for years so for me this report lights no fires

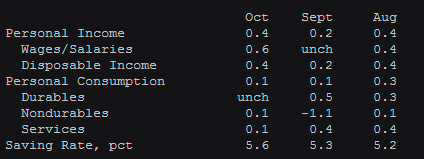

Personal incomes/spending

Consumers wallets still doth not runneth over with dollars and dimes. We saw wages rise 0.6% and disposable incomes +0.4% but it's all been going into savings accounts and not shop tills. Savings rose to the highest since Dec 2012 at $761.9bn vs $722.9bn in Sep. On one hand that's good as it shows that there is more spare cash and that people want to build up savings. The flip side is that the money is not going to oil the economy via spending

US incomes/spending

That means that the US consumer is heading for a better place, as when they've finished saving they'll start spending, but that means that this protracted period of steady, not spectacular spending is set to continue

For the Fed, they'll take this as a signal that people have enough leeway in finances to weather a rate hike

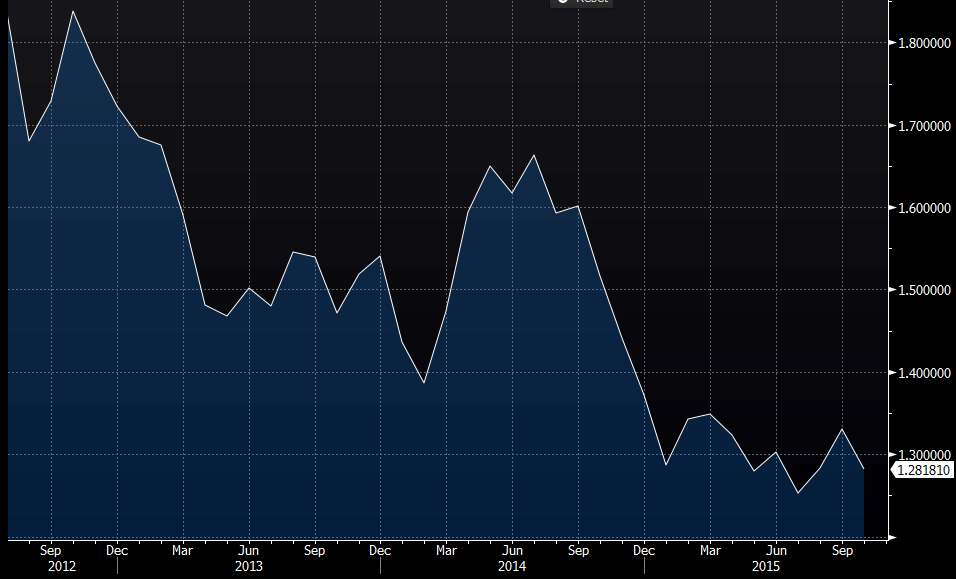

PCE prices

I said in my durables post that the core fell but it was unchanged. Month on month we were largely flat and if the core had ticked up that would have been very welcome to the Fed. In finer detail core pce came in at 1.28% vs 1.32% in Sep. A minor point and the market takes the rounded number, but this figure hasn't shown any real signs of picking up this year. That's a point the doves will be worried about. As transitory as some will make out, prices trending higher would be more icing on the cake for a hike. At the moment is looks like inflation could go either way from here

US core PCE y/y

Overall

The biggest take is that there's no real shocks here and a smattering of good and bad news. Nothing to rock the boat. That's probably good enough for the Fed right now and further enforces my "steady" view on the US economy. There's no reasons here for the Fed to change course on whatever they decide to do in Dec