Earnings the disappointment but jobs strong

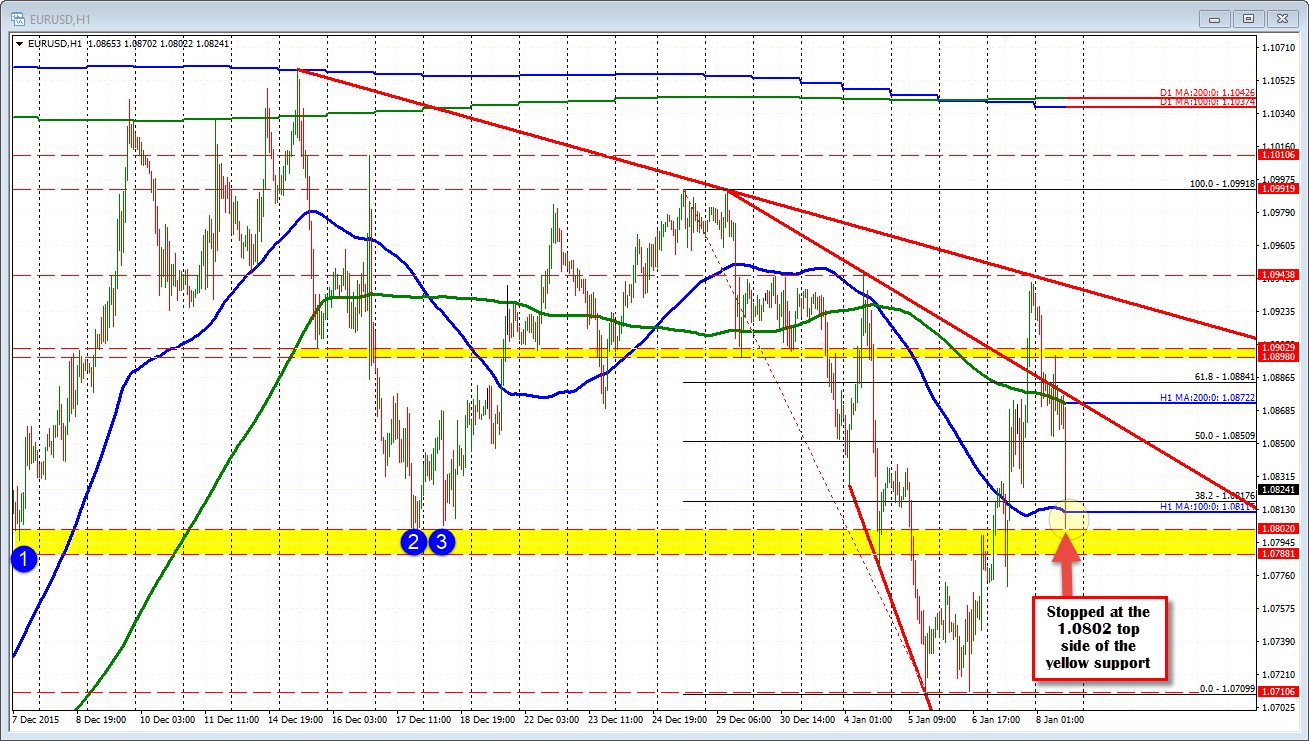

The EURUSD is falling sharply on the back of the stronger US employment jobs gains. The S&P is higher at a +30 points as a result. The NASDAQ is up 77 points. The dollar is moving higher, led by the euro's decline. Technically looking at the euro, the price has moved to the 10788 – 1.0802 support level. The low comes in at 1.0801 so far. That is the low from Dec 17. The 1.0788 is the 50% of the move up from December low.

The price is correcting higher now., but the correction has stalled against the 50% of the trend move lower (see yellow area in the chart below). That level comes in at the 1.08359 level. The market action is volatile, but finding sellers in that area is suggestive of traders wanting to get short on the correction. A move above may muddy the waters with a move toward the 1.0854 lows from earlier in the day.

A great number, if it weren't for the earnings. Lower earnings does not help the inflation side of the Feds dual mandate for job growth and 2% inflation target. In any case the strong jobs should keep the dollar supported as talk of March tightening becomes the norm (was April before the number). At the same time, it should take some pressure off the stock market with lower inflation. If the Fed is going to gradual tightening. that might be the best case scenario.