Patience is removed but it's not liftoff yet for US interest rates

Finally the Fed has acknowledged that the economy isn't all it's cracked up to be.

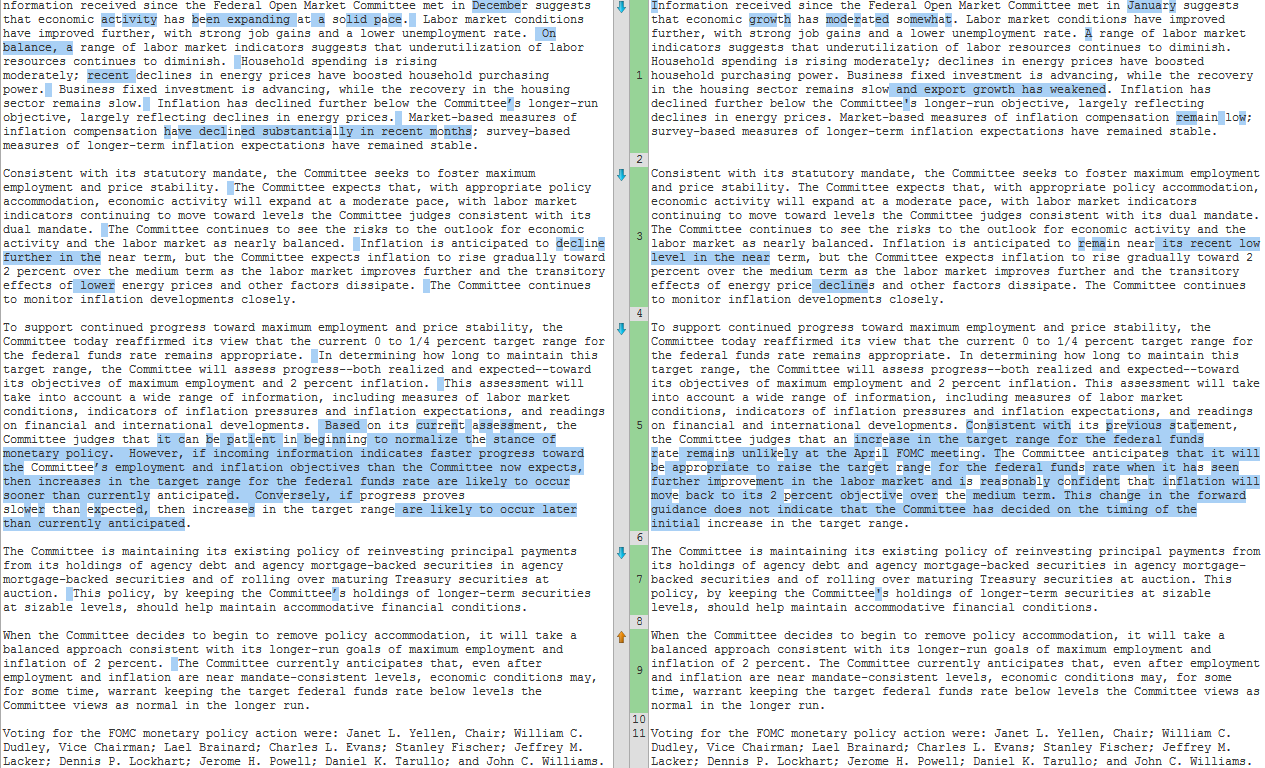

From a

"activity has been expanding at a solid pace"

We've gone to

"Economic growth has moderated somewhat"

On inflation the statement suggests that we're near the bottom as the

"decline further"

has changed to

"remain at it's recently low level"

This statement is almost a complete u-turn on the hawkishness from the last one where expectations of raising rates sooner than expected have turned into a wait and see game

Consistent with its previous statement, the Committee judges that an increase in the target range for the federal funds rate remains unlikely at the April FOMC meeting. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term. This change in the forward guidance does not indicate that the Committee has decided on the timing of the initial increase in the target range.

They've ruled out April for rate rises and that they are tying rises to even more improvement in the jobs market smacks of grabbing any excuse but the real one that the economy is not as hot as they thought. The Fed is in a battle. They want rates up but they are facing the prospect that after all these years of QE and trying to inflate the economy they have not a lot to show for it and what they have got is very close to going backwards

Here's the full statement comparison. (Jan on the left)