Traders are hovering up the buck

There's only one major currency winning today and that's the US dollar. It was noted earlier today that players were adding to long positions and we can see the effects across the board. The aussie is down, the Swissy is down, the CAD is down. The only pair that's not shooting higher is USDJPY, which is being bogged down by the crosses.

Most of the moves are tying up with the expected Dec hike by the Fed. That probability stood at 67.6%, which is up from the post-NFP 64.3% on Friday.

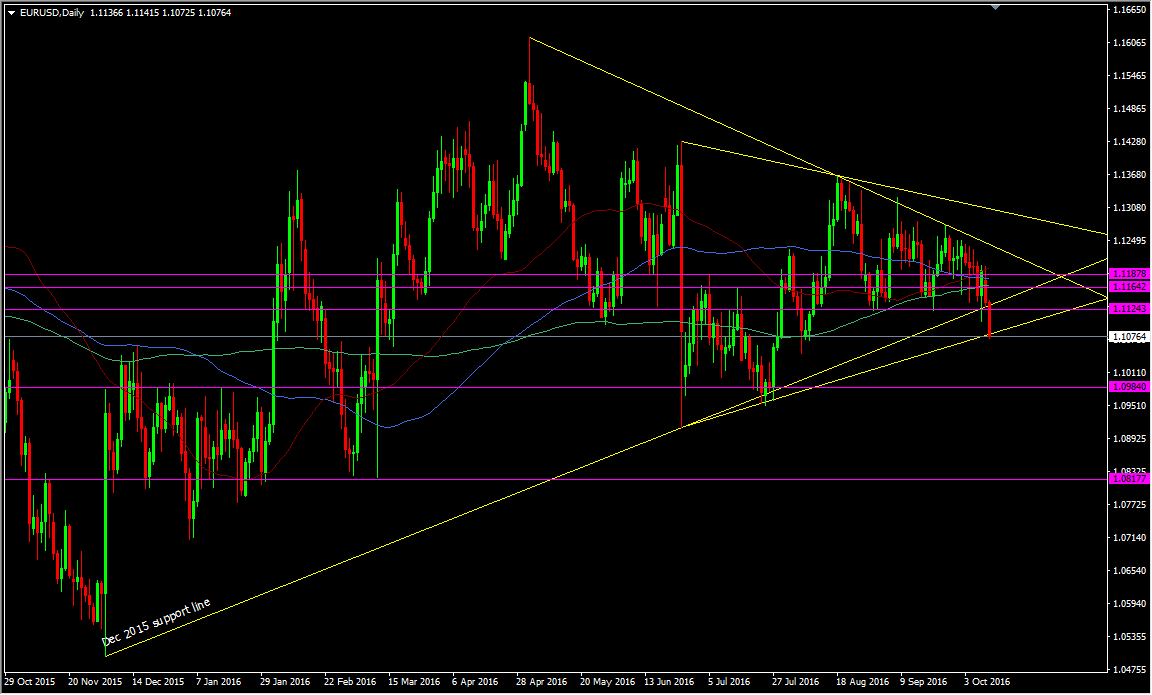

EURUSD was the pair of choice for those adding to longs today and we've seen it move below a recent S&R point around 1.1120/25. We've already seen the 1.1115 level offering resistance but the break accelerated through 1.1100 and we've barely looked back.

Further out we are in the process of breaking Dec 2015 and have mild support just under from the action around late July/early August.

EURUSD daily chart

Additional support will be placed down around 1.1040/50 and 1.1020 before we knock on the 1.1000 door. At that point we have an old support area around 1.0980/85. This level was a strong resistance point for 1.10 back in Dec and it's been a level that's faked out a lot of shorts when 1.10 has broken. That run happened in July and despite seeing the price dip below on several occasions, we couldn't get and hold below, and that was the key factor in the subsequent bounces.

For the pound, traders keep pilling the dirt into its grave and there's a long list of those hitting the rallies with the interbank, leveraged and real money doing the damage today. It looks like the market has picked itself up from the crash and seen that no one has wanted to take it back higher, so they've regained confidence in shorts and resumed selling it instead.

The technical picture is pretty clear from here and that's to keep an eye on the 1.2220/25 level as that's the first real low after the initial blow out.

GBPUSD H1 chart

It's also a level that some of these recent shorts are looking at to take profit as they have bids layered down at 1.2230, 1.2200/10 and at 1.2175/80. You can add them in to the orders Mike had earlier.

In one sense the market is discounting a Fed hike in Nov and so there's some risk there if they do, as it will catch the market off guard, even if most are leaning that way with USD longs anyway. If the Fed don't hike in Nov then any decent dip in USD will be worth buying to run into the Dec FOMC.

Both the euro and pound face a very different scenario with dovish expectations for the BOE's Nov meeting, and how the ECB will skate around the March 2017 QE end date in its next two meetings so expect those dollar dips to be quite weak.