Here is Deutsche Bank on the Bank of Japan meeting

(Reminder - the BOJ meet today and tomorrow with the announcement to come on Wednesday Japan time. There is no scheduled time but I'm thinking it'll be after 0300GMT. Anyway, back to DB ...)

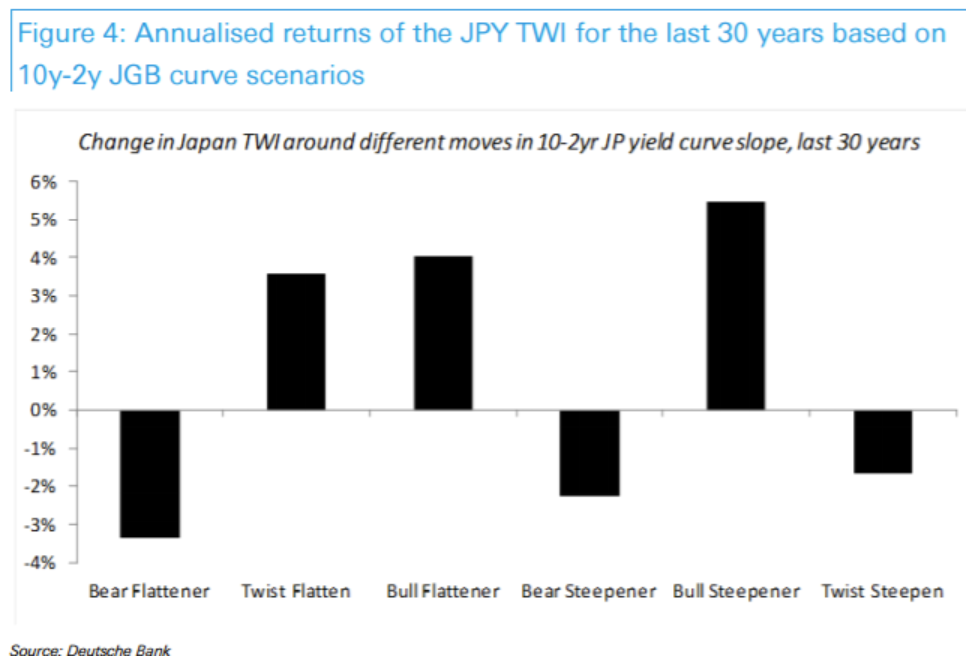

Past price action supports the idea that IF the BOJ were to pursue an 'operation twist' to steepen the JGB yield curve, via lower 2y yield with higher 10y yields, it will initially work in the direction of a slightly weaker JPY and support the Nikkei, and not contradict the BOJ's other objectives to support Japan's financial sector.

Twist operations however should not be directed at FX goals. Since 2009, an average week where the curve twists steeper is 3bps for 10y - 2yr JGBs, and this has only been associated with a 0.12% depreciation in the JPY TWI. Curve manipulation should get filed in the 'fiddling around the edges' folder, since the overall impact on the price of money will be negligible and will not change Japan's growth and inflation profile meaningfully.

The intra-week response of a weaker yen in the face of an engineered steeper curve would almost certainly wear off quickly with the currency soon dominated by other factors.

The BOJ policy assessment is bound to provide at least a few intriguing insights, but all of this should get filed in the 'fiddling around the edges' folder, since the overall impact on the price of money will be negligible and will not change Japan's growth and inflation profile meaningfully.

For all the earlier hope that the Fed and BOJ were both going to support USD/JPY, the risks are now firmly skewed in the direction of disappointment and a stronger yen.