Deutsche Bank on the Bank of Japan meeting this week (15th & 16th)

We view further easing by the BoJ as unlikely. Given the recent risk of a Brexit, the BoJ naturally has to be cautious regarding taking additional easing measures ahead of the UK referendum. Although we are maintaining our official outlook that the BoJ will lower its negative policy interest rate a further 0.1% in Jul-Sep, we believe that the need for further easing has decreased somewhat with the more pro-active fiscal stance of Abenomics.

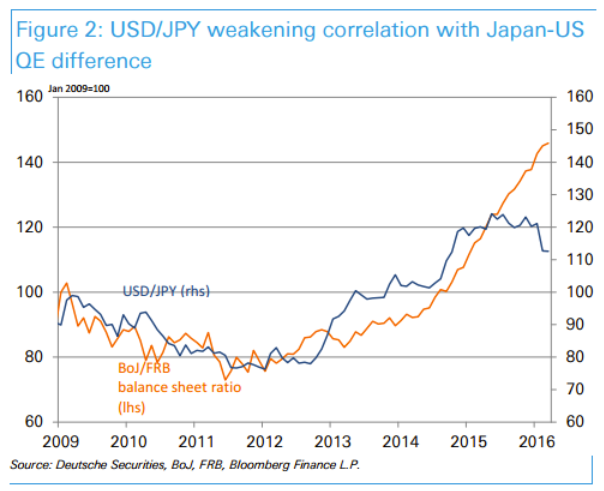

Regardless of whether or not the BoJ puts off additional easing, we see downside risks dominating the USD/JPY market as long as the US economy remains sluggish. The BoJ's introduction of negative interest rates on 29 January could not prevent yen appreciation as the US economy lost momentum. The correlation between the USD/JPY and Japan-US QE differences has already started weakening. Our economists see the US economy remaining at below cruising speed for the first three quarters of 2016. Risk markets could become nervous rather than assured if the Fed raises rates during this time, which makes it difficult to project the USD/JPY remaining airborne.

Our official forecast calls for the USD/JPY to reach 103 by end-June, and 101 by end-September.