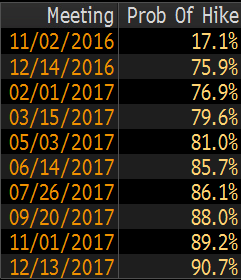

Fed funds futures price in 76% chance of hike

Immediately after the GDP numbers, Fed funds slumped and momentarily priced in more than an 80% chance of a hike in December.

That's slipped back to 75.9% with the probability of a surprise next week still at 17%.

Jon Hilsenrath is out with a report saying the Fed won't repeat what it said in the statement before its December meeting last year.

It read like this:

"To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining whether it will be appropriate to raise the target range at its next meeting, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation."

By mentioning 'next meeting' it was viewed as essentially a pre-commitment. Hilsenrath said they won't do that for three reasons:

- The Fed has worked hard to get market expectations to the healthy level where they are now. That aligns with what they see and wants to keep them around where they are now, which is part of a hoped-for shift towards soft guidance rather than explicit guidance.

- The Fed is trying to get away from calendar guidance. It's trying to connect outcomes to data and the economy and not get tied to doing or promising certain things at certain times.

- Another reference to 'next meeting' would condition markets to only believe a hike is coming if the Fed uses that line. So they would risk being stuck with it our surprising markets at some other time.

To me, that third point is especially salient.