Forex futures market speculative positioning data from the CFTC Commitmentsof Traders report as of the close on Tuesday May 26, 2015

- EUR net short 172K vs. short 168K prior

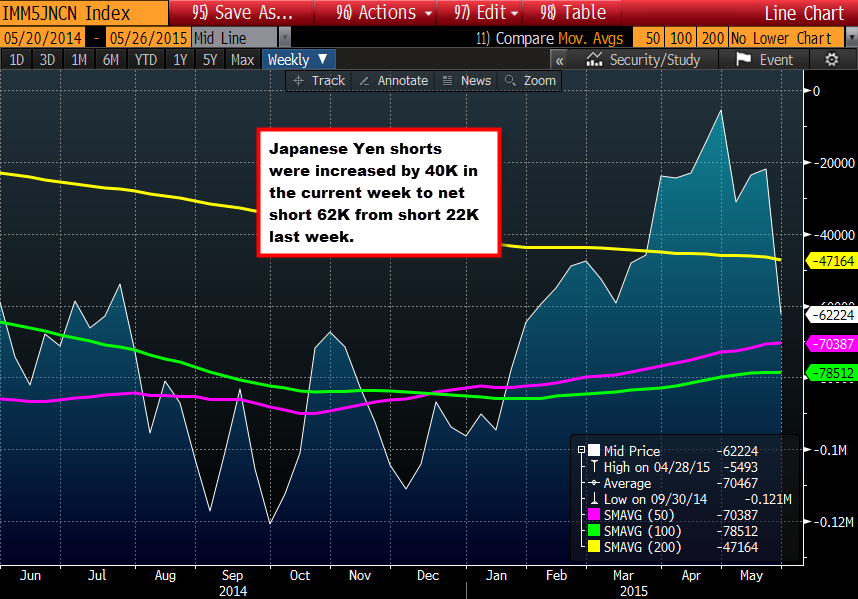

- JPY net short 62K vs. short 22K prior

- GBP net short 26K vs. short 23K prior

- AUD net long 6K vs long 7K prior

- CAD net long 7K vs long 4K prior

- CHF net long 8K vs. long 9K prior

The JPY shorts increased in the current CFTC Commitment of Traders report for the week ending May 26th. The short position - seems to have been properly timed as the JPY has weakened into the reporting period.

In other positions of note, the EUR short increase to 172K from 168K the prior week. The AUD, CAD and CHF positions are all close to being square. The EUR short was as high as 227K on the week ending March 31, 2015. This is the first increase in shorts since April 21 week.